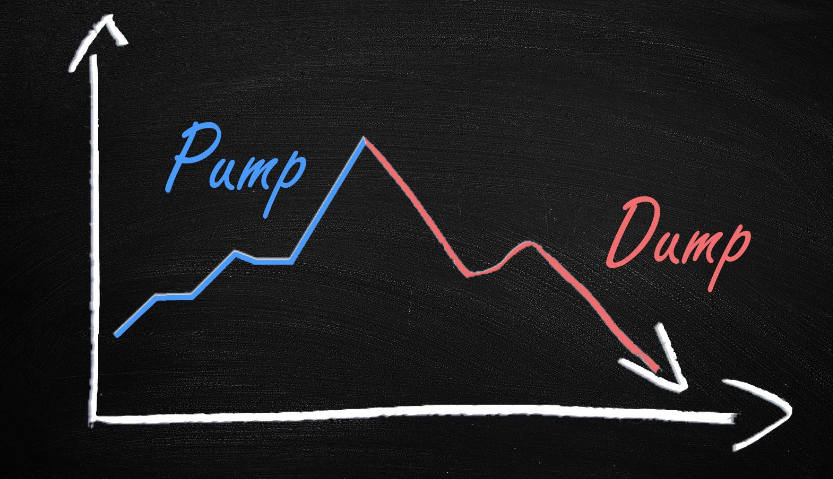

– VBL Therapeutics (VBLT) put out a PR for its ovarian cancer drug, VB-111 with the word “positive” in the title. However, the drug is a complete failure and the data isn’t positive at all.

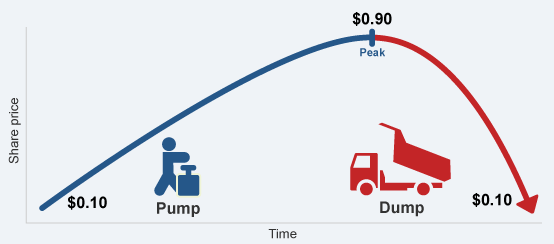

– The word “positive” in the title mislead investors and is what caused the stock to rise from a close on May 13th of $4.08 to the mid $5 range today.

– VB-111 + chemotherapy combo has a worse response rate than chemo treatments alone. Avastin +chemo for ovarian cancer showed a much better response rate than both the VB-111+chemo combo and chemo alone.

– VB-111 didn’t show any improvement of reduction in muellerian (ovarian cancer) tumors , so had a 0% objective response rate.

– VB-111 is also very toxic, causing many serious adverse events, and even causing a death in the small 14 patient trial.

– VB-111 is ineffective and toxic, and should not be used in any more trials, for any type of cancer.

– VB-111 was VBLT’s last drug, and it has nothing more in its pipeline. The company is worth its cash value or less.

In the after hours on May 13th, VBL Therapeutics (VBLT), put out a PR with the title: VBL Therapeutics To Present Positive Phase 1 /2 Data for VB-111 in Recurrent Platinum-Resistant Mullerian Cancer at ASCO Annual Meeting.

Because the word “positive” is in the title, investors thought the trial was successful and the stock rose from a close of $4.08 on May 13th, to over $7 on May 14. The stock has now settled in the $5-$6 range. But the truth is, the data is not positive, it’s very negative. VB-111 is a complete failure. The data shows that not only is the drug ineffective in fighting tumors, but is also very toxic and dangerous and shouldn’t be used in any more trials. The stock should have fallen on the data, not risen. There should be some legal ramifications for the company to put such a misleading title. The following data points and trial comparisons with other drugs show why VB-111 is a failure and should be discarded.

CA 125 Is Not The Proper Response Criteria

Here is the VB-111 ASCO data for mullerian cancer (which is primarily ovarian cancer) that VLBT released on May 13th . VLBT used the biomarker CA 125 to state that VB-111 had a 57% response rate. This alone is a red flag. CA 125 is a protein that is commonly used as a biomarker to predict what kind of response certain drugs will give. It isn’t meant to be used as the final measure of a response. For example this report states the lack of reliability of CA 125: “Three patients would have terminated treatment prematurely had CA125 had been used.”

RECIST (Response Evaluation Criteria in Solid Tumors) is the golden standard to evaluate responses. RECIST shows ORR (objective response rates), while CA 125 just shows “response rates” that aren’t objective. RECIST measures the tumor level after the patient takes the drug. The RECIST partial and complete responses (both tumor shrinkages) are what really matters in evaluating the drug’s efficacy.

Using CA 125 criteria, VB-111 had a 57% response rate, and that’s probably what people think is positive and why the stock went up. However, using RECIST, VB-111 had a shocking 0% ORR. 8 patients out of 13 had a stable disease response from the RECIST criteria but in order to get an ORR, RECIST requires some improvements in shrinking the tumor. There were no partial or complete responses using the RECIST criteria. For an example of a better result from an ovarian cancer trial, here it states the results of Clovis (CLVS) treatment of ovarian cancer that showed a RECIST ORR of 65% and 40%.

But wait, the results for VB-111 get even worse. The patients in the study weren’t only on VB-111, but also on chemotherapy: paclitaxel. It’s a combination study. Usually some patients on chemo alone should get a RECIST partial response. Yet in combination with VB-111, none of the patients even got that. Patients also usually get a longer median progression free survival (PFS) on chemotherapy alone than with the VB-111+chemo combo. Here is a study from 2003 for mullerian tumors using a doxorubicin and paclitaxel combination. There were 4 patients with a complete response and 7 with a partial response out of 38 patients for an ORR of 29%.

Avastin Is Far Superior To VB-111

Here are the results of a phase III trial evaluating Avastin (bevacizumab) plus chemotherapy for platinum-resistant recurrent ovarian cancer. It shows the results using chemotherapy alone, and an Avastin plus chemotherapy combo. The following is a chart of the results:

The above column, CT, is chemotherapy alone, and BEV+CT is the Avastin + chemo combo. The fourth line down, the median, shows the progression free survival (PFS). For CT, it shows the median PFS is 3.4 months, and BEV+CT is 6.7 months. Now, looking back at VB-111 data, the median PFS is only 2.0 months. That’s less than the median PFS of the chemotherapy alone, which is 3.4 months.

Then, the next line down in the above chart is the ORR (objective response rate). The CT alone is 12.6%, BEV+CT is 30.9%. The VB-111 + chemo ORR is 0%. Again, further data shows patients would have been better off with chemo alone instead of in combination with VB-111.

Adverse Events

Now, let’s look at the adverse events. When measuring the severity of adverse events, there are five grades. Grades 1 and 2 aren’t so bad, but grades 3-5 are really bad. In the BEV + CT data above, it shows that 14% of the 179 patients had grade ≥ 3 adverse events and no deaths. VB-111 data had 11 grade ≥ 3 adverse events with only 14 patients – and one death! This shows that VB-111 is a very toxic and dangerous drug.

Mullerian Cancer Is Primarily Ovarian Cancer

Some people get confused with the difference between mullerian and ovarian cancer. A mullerian tumor is a malignant neoplasm found in the female genitalia. Ovarian cancer is the major type of mullerian cancer. VBLT mostly enrolled ovarian cancer patients, as shown on clinicaltrials.gov. It says “Platinum Resistant Ovarian Cancer” for the VB-111 study, exactly the same as the Avastin study shown above. On VBLT’s website, it saysthe study was on ovarian cancer. It’s an appropriate comparison to the ovarian cancer studies shown above.

After VB-111, VBL Therapeutics Has Nothing Left In The Pipeline

With the failure of VB-201 in February, the only drug that VBLT had left, aside from some preclinical experiments, was VB-111. With such lack of efficacy in fighting mullerian tumors, and the dangerous toxicity of the drug, it should also be considered a failure and the trials shouldn’t be continued as VBLT planned for thyroid cancer or glioblastoma. Without VB-111, VBLT really has nothing left and needs to start over from scratch.The company reported $34.4 million in cash and equivalents on March 31, 2015. The market cap should be around cash level or slightly less since the company needs to start from ground zero. However, the company will likely be doing more fruitless VB-111 trials and burning lots of cash, which will decimate the share price with stock dilution and future trial failures.

Get Our Latest Reports Delivered To Your Inbox (we will not share your email with anyone)