Matinas BioPharma Has A Weak Drug Pipeline And Investors With Fraudulent Histories

Matinas BioPharma (MTNB) is a clinical stage biotech focusing on identifying and developing therapeutics for the treatment of fungal and bacterial infections. We believe this is one of those very rare, no-brainer short selling opportunities. We don’t say this too often. Upon reading this report, we hope you agree. Matinas only has two drugs in its pipeline that it acquired two years ago from Rutgers University for $2.5M in stock. Since the acquisition, the company has not yet shown any clinical efficacy data from those trials.

Matinas first started trading on the OTCBB exchange on July 22, 2014, and had moved to the NYSE on March 2, 2017. As investors who follow small cap stocks know, stocks that trade on the OTC exchange can become massively overvalued. Stocks on the NASDAQ and NYSE can also become massively overvalued for a short time, but they usually move towards their fair values pretty quickly. This is because there’s more scrutiny, more orderly trading, better regulation, and better

liquidity on the NASDAQ and NYSE. Professional short sellers like hedge funds often feel more comfortable shorting stocks on the NYSE or NASDAQ compared to the OTC exchange. We believe this is clearly true in the case of Matinas, and since Matinas has moved to the NYSE two weeks ago, the stock has fallen over 20%.

MTNB’s share price is now at $3.00 and we believe the stock has a fair value of around $0.63. The stock was trading at $0.50 per share only 10 months ago, and there has been no big fundamental developments or changes in the company since then. We believe in a matter of months MTNB will be trading at $0.60 – $1.60 per share, for a 45-80% decline.

Matinas BioPharma’s Valuation Estimate

Matinas only has two drugs in its pipeline named MAT2203 and MAT2501. The Company acquired these drugs from a Rutgers University spinoff, Aquarius Biotech, on January 31, 2015 for $2.5M worth of stock. The deal was 5M shares of stock up front, and MTNB was trading for $0.50 at the time. Then an additional 3M shares as milestone payments will be issued to Aquarius if either drug reaches FDA approval. There were no promised royalties in this deal.

Since the acquisition, Matinas has gotten fast track and orphan drug designation from the FDA, but hasn’t reported any new efficacy results from clinical trials yet. To estimate the value of MTNB, lets say Matinas got a good deal, and the drugs are actually worth $10M instead of $2.5M. Then lets say because of Matinas drug research platform, its designations from the FDA, and sponsorship deals it got with the National Health Institute (NIH) and the Cystic Fibrosis Foundation to conduct trials, that adds another $20M to the company’s value. The company has about $10M in cash, so that values the total company at $40M. With a currently hot small cap biotech market, we’ll give a 50% premium to Matinas fair value, valuing it at $60M.

Including outstanding warrants to purchase about 9 million shares, and about 87 million shares outstanding, that makes 96 million outstanding shares. At $3.00 per share, Matinas’ market cap is a whopping $288M! That’s a premium of $228M over what the company is worth from this valuation estimate. At a $60M value, with 96 million shares outstanding, that values the company at $0.63 per share. That’s an 80% downslide for the stock at today’s price. Now that the stock is trading on the NYSE, we believe it will only take a couple months for it to drift down to $0.60-$1.60 per share.

Matinas Cheap Acquisition Price For Its Pipeline Suggests The Drugs Are Likely Ineffective

Matinas acquired its current pipeline, drugs MAT2203 and MAT2501, from Rutger’s University for $2.5M. This means the drugs are probably not going to amount to much and Rutger’s wanted to dump them off for a small sum. This is not a knock on Rutger’s Medical School, it’s one of the best in the country. But if the drugs had value, the school would probably have known and sold them for a lot more.

Upon the acquisition, MAT2301 had already gone through phase I trials and phase 2a trials were set to start as soon as possible with anticipated sponsorship by the National Institutes Of Health (NIH). MAT2501 had already showed positive results in preclinical trials tested on mice. If there was something really promising here, Rutgers would’ve likely continued studies for the drugs to gain value. But Universities often dump off the drug assets they don’t want to biotech companies for cheap, as is the case here.

If it was this easy to start a small cap biotech company, a doctor could just go to the research lab at Harvard University, buy the drugs they created but don’t want to spend any more time on for a few million dollars, and then start a biotech company on the OTC exchange. Then, instead of rushing into clinical trials, wait for the company to reach a one hundred million dollar market cap on the OTC exchange by promoting it on Twitter, Events, and getting Analyst Buy Ratings, and then transition to the NYSE or NASDAQ. This is effectively what Matinas did.

A Biotech Should Not Have A Multi-Hundred Million Dollar Valuation Until It Shows Positive Efficacy Data

We believe the $55M market cap of similar hot biotech, Pulmatrix (PULM), would be a more accurate price area for Matinas. Like Matinas, Pulmatrix also is developing an anti-fungal drug to treat patients with cystic fibrosis. Also like Matinas, Pulmatrix has been granted Qualified Infectious Disease Product (QIDP) by the FDA. Pulmatrix is also developing a branded generic to treat chronic obstructive pulmonary disease.

PULM’s market cap remains below $100M because its trials are in early phase 1 testing. If it shows good efficacy in its early phase 2 trials, then it could merit a $100-$200M valuation, but not before.

Matinas already has a market cap of over $200M before it has reported any efficacy data. That’s putting the cart before the horse, and a correction is in order. If the efficacy data turns out to be good from the current MAT2203 phase 2a trial of only 16 patients, then there won’t be much upside to the stock anyways because it’s already at a $200M+ valuation.

Notorious Stock Promoters Are Involved With Matinas

The following are the notorious stock promoters that are working with and/or are invested in Matinas:

GJG Capital – A Vehicle Designed To Buy And Sell Shares Of Matinas

Who is GJG Capital? Our research may shock you. We’ve found evidence that GJG Capital is an investment vehicle created to only buy and sell shares of MTNB, and is run by permanently barred broker Gregg Lorenzo. The following path is how we came to our conclusion.

As shown on its SEC filings page, GJG Capital only exists to own stock in MTNB. It doesn’t report owning any other security.

As shown in Matinas’ latest Form 4 on 3/15/17, GJG Capital is the indirect owner of 10.5M shares of MTNB, and the direct owner of 500K shares, to total 11M shares, making GJG Capital the Company’s largest shareholder. The Form 4 shows the following information of the reporting person:

Who is Jennifer Lorenzo? Here is her LinkedIn Profile:

It says she is the Principal/Founder of GJG Capital. But then look at her work history:

As shown above, her work experience includes being an admin assistant for six years for Staten Island Honda and Nissan.

So this admin assistant all of a sudden decides she wants to start a huge investment firm and then attains a $33M position in Matinas?

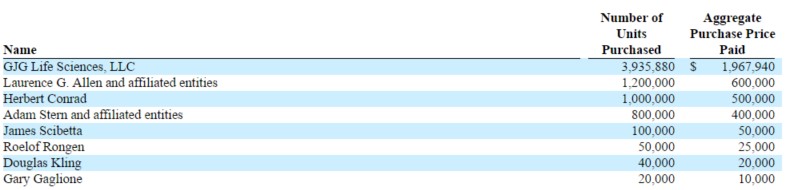

From the latest 10-K, it shows GJG Life Sciences was the biggest buyer in Matinas’ 2015 private placement, purchasing 3.9M shares for about $2M.

How did Jennifer Lorenzo, an administrative assistant, come up with $2 million? We did some more digging.

From a Google Image search, we found a picture of Jennifer Lorenzo with Gregg Lorenzo and their baby. This shows that Jennifer Lorenzo is married to barred broker Gregg Lorenzo.

Here is Gregg Lorenzo’s picture from his Ripoff Report complaint:

As shown on BrokerCheck, Gregg Lorenzo is a permanently barred broker with a history of securities fraud. The website shows he has a history of excessive trading, omission of facts related to investments, and making unsuitable investments for clients.

With Gregg Lorenzo being the largest shareholder in Matinas, this could get the eyes of the SEC on the company. We know Mr. Lorenzo has no qualms about breaking securities laws.

Matinas Investment Banking Firm Aegis Is Highly Compensated And Biased

Matinas is being promoted by Sell Side Analyst Aegis. It’s clearly biased as Adam Stern, Head of Private Equity Banking at Aegis, is on Matinas’ board of directors. Aegis is also being richly compensated by Matinas for being its Private Placement Agent. From the latest 10-Q (emphasis ours):

We entered into a Placement Agency Agreement with Aegis Capital Corp. pursuant to which Aegis acted as our exclusive placement agent for the 2016 Private Placement. Immediately prior to the 2016 Private Placement, the Placement Agent and its affiliates beneficially owned an aggregate of more than 10% of our outstanding equity securities. In addition, Adam Stern, Head of Private Equity Banking at Aegis, is a member of our board of directors. Pursuant to the terms of the Placement Agency Agreement, in connection with the 2016 Private Placement, we paid the Placement Agent an aggregate cash fee of $800,000 and a non-accountable expense allowance of $240,000 and have issued to the Placement Agent warrants to purchase 1,600,000 shares of common stock at $0.50 per share. These warrants are equity classified and accounted for as preferred stock issuance cost within equity. The warrants provide for a cashless exercise feature and are exercisable for a period of five years from the date of closing. We have also agreed to pay the Placement Agent similar cash and warrant compensation with respect to, and based on, any individual or entity that the Placement Agent solicits interest from in connection with this Offering

The above payment to Aegis is excessive. $1.04M in cash, plus 1.6M warrants, and additional compensation if Aegis is able to solicit interest in other parties to invest in the private placement.

Howard Appel, Another Barred Broker Investor

Howard Appel is another shady character involved with Matinas. As shown in this SEC filing, one of the major shareholders was or is DIT Equity Investors, an investment firm run by Howard Appel. As shown in this article, Howard Appel is a barred stock promoter, and did one year in jail in 2008 for securities fraud. He has taken part in numerous small cap stock promotions such as Florida West Airlines, Net Value Holdings, and Eastwind Group.

Rafaele Ricci,

Matinas’ Drug Pipeline

As shown on the company’s website, Matinas only has two drugs in its pipeline: MAT2203 and MAT2501.

MAT2203 (CAmB)

MAT2203 is a lipid-crystal nano-particle formulation of Amphotericin B. Amphotericin B is a well-known broad spectrum fungicide currently available by IV-only administration with significant side effects (including nephrotoxicity). MAT2203’s difference is it’s taken orally. It got an IND application from the FDA while it was owned by Aquarius. The Phase 1a trial was performed at Rutgers with 48 healthy volunteers and showed a positive safety and tolerability profile with no adverse events reported. It supports phase 2 efficacy studies. Matinas planned to advance MAT2203 into phase 2a efficacy studies as quickly as possible in 2015, but that didn’t happen.

MAT2501 (C-Amikacin)

MAT2501 is a formulation of Amikacin. It’s currently in the preclinical development stage. Amikacin is an antibiotic used to treat severe hospital-acquired infections. Like Amphotericin B, it’s also only delivered through an IV and has very serious side effects. MAT2501 is an oral administration of Amikacin.

Raphael J Mannino, PHD, the founder of Aquarius, went on Matinas’ Scientific Advisory Board after Matinas acquired Aquarius.

Looking at the two drugs:

MAT2203 – This is a special formulation of Amphotericin B. It is a well-known antifungal, but is also very harmful to the kidneys, so it is only used in life or death situations by IV only. Matinas theory is that their way of encapsulating the drug, its cochleate delivery technology, will keep it from being harmful while also allowing it to be absorbed by the body when taken orally.

However, this idea was originally licensed from Rutgers by another biotech called Biodelivery Sciences (BDSI) in 2002. Dr. Raphael Mannino was on BDSI’s management team at the time. BDSI did a phase 1 trial in 2009 of the cochleate delivery technology (now MAT2203). It was safe and well tolerated, however, the efficacy must not have been good enough. BDSI terminated its relationship with Dr. Mannino in September, 2009, and decided to discontinue its developments of the cochleate delivery system.

In 2012, BDSI then gave the license back to Rutgers for 10% of future potential revenues following commercialization of the formulated amphotericin B products (now MAT2203). Aquarius Biotechnologies was formed in June, 2012, founded by Dr. Mannino. In 2013, Aquarius negotiated terms of a license agreement with Rutgers for the exclusive rights to commercialize MAT2203. Aquarius was then acquired by Matinas in January, 2015. Dr. Mannino went on Matinas’ Scientific Advisory Board (SAB) and became its Chief Scientific Officer.

A Look At Matinas News During Its Monster Rally From December To Today

As shown in the MTNB stock chart at the beginning of this article, MTNB rallied huge from the end of December, 2016 to today. It went from a low of $1.25 on December 22, 2016, to a high of $3.99 on March 2, 2017, the day it transitioned to the NYSE. From there, it has steadily drifted down to $3.20 today. The following is a look at the news around that time period to see if the stock merited its 200% run-up, or if it will be expected to revert back to the $1s. In our opinion, the news isn’t good enough to merit such a rally, since there’s no clinical trial efficacy data, and the stock will likely continue its downtrend reversal.

Matinas Press Releases

Sep 28, 2016: Matinas Commences Patient Dosing In NIH-Sponsored Phase 2a Study With Lead Anti-Infective Candidate MAT2203

This PR announced that dosing has just started in the MAT2203 phase 2a study for the treatment of mucocutaneous candidiasis infection. On February 8, 2016, there was another PR that announced the NIH started enrolling patients. So it took eight months to enroll only 16 patients and now they’re ready to dose? That seems like a really long time to find eligible patients for the trial.

Nov 21, 2016: Matinas Initiates Enrollment and Commences Patient Dosing in Phase 2 Study of MAT2203 for the Treatment of Vulvovaginal Candidiasis

This PR states that the NIH is also testing MAT2203 for the treatment of vulvovaginal candidiasis, in addition to mucocutaneous candidiasis as explained in the last PR. The NIH is looking to enroll 75 patients and start dosing right away. This is positive that the trials are ongoing, but the efficacy results aren’t known at this point, so the stock shouldn’t be trading too high. MTNB still traded in the mid $1s on this date.

Dec 8, 2016: Matinas Receives Contract Award from Cystic Fibrosis Foundation Therapeutics to Study MAT2501 for the Treatment of NTM-Infection in Pre-Clinical Models of CF

The Cystic Fibrosis Foundation has given Matinas an award to study its antibiotic MAT2501 for the treatment of cystic fibrosis. It will support a collaborative research effort between Matinas and Colorado State University to study the efficacy of MAT2501. One would think this was good news but shareholders didn’t think so as the stock didn’t go up. It drifted down from $1.50 on December 8th to $1.25 by December 22nd.

Jan 19, 2017: Matinas Raises $13.5 Million From The Exercise Of Warrants

It’s good that the company raised a little bit of money, but notice this PR doesn’t say at what price the warrants were exercised. That took some digging. The exercised warrants added about 29 million shares outstanding, which means the exercise price came to about $0.47 per share. It raised the outstanding common stock total to 87.3 million shares, and outstanding warrants to purchase 9.3 million shares of common stock.

January 26, 2017: Matinas Provides Business Outlook And Corporate Milestones for 2017

This business outlook reported a lot of upcoming news for the company:

- Report top-line results from NIH-sponsored Phase 2a study of MAT2203in immunocompromised patients in 1H 2017;

- Report top-line results from Phase 2 study of MAT2203 in patients with vulvovaginal candidiasis (VVC) in 1H 2017; and

- Commence tolerability/PK study of MAT2203 in patients with a hematologic malignancy in 1H 2017 to position this lead product candidate for a pivotal study in this population.

- Report top-line results from Phase 1 study with MAT2501in 1Q 2017;

- The company announced it would be uplisted to a national securities exchange in Q1 2017.

The above updates all look good, but they were already known by shareholders. Also no efficacy data has been reported yet, so there’s no reason for a rally. But the stock did rally hard the next couple of weeks from a $2.06 close on 1/26/17.

In late December, MTNB was trading for around $1.30. Then it started going up in January, and after this business outlook on January 26, the stock went from the low $2s to the high $2s. Then it went into the $3s and high $3s in February, until it hit the NYSE exchange when it started to decline.

Mar 6, 2017: Matinas and NIH/NIAID Initiate Open-Label Extension to Phase 2a Study of MAT2203 in Chronic Mucocutaneous Candidiasis

This sounds good to have an additional six months of safety data for patients using MAT2203. But that pushes out the timeline of this trial before they can get good efficacy data. This news was after the stock transitioned to the NYSE, so it is fading at this point and went lower.

Mar 8, 2017: Matinas Announces Positive Preclinical Efficacy Results of MAT2501 in an In Vitro Model of Mycobacterium Abscessus Infection

Now, finally, Matinas is releasing efficacy results from its trial going on at Colorado State University. The company delivered what it had said it would do in the above 12/8/16 PR, and this should be good for the stock, right? Nope, the stock declined further on this news. Efficacy results from preclinical and phase I studies aren’t very reliable. It’s not a test on patients, and the scientists can manipulate or misread the data to fit their desired results very easily.

There Are No Upcoming Catalysts That Would Move The Stock Much

There aren’t any near term catalysts that would make MNTB return to highs. One event, as shown in the business outlook PR listed above, is topline results from a phase 1 study of MAT2501 are scheduled to come out in March. Phase 1 studies are just supposed to test safety and tolerability of a drug. It doesn’t test for efficacy, so it doesn’t show the value, if any, of the drug. Whatever the results show, likely that MAT2501 is safe, likely won’t move the stock at all. The only other near term events are coming in the latter half of 1H17. They are top line results of two phase 2 studies of MAT2203, and the results of another MAT2203 study. MTNB stock has plenty of time to decline before the data from those studies comes out.

Without Good Efficacy Data, There’s Nothing There – Prepare For The Dump

MTNB stock price tripled between 12/22/1 and 3/2/17, and doubled between 1/26/17 and 3/2/17, yet there weren’t any business-related news to merit such a runup, only the uplisting. Matinas hasn’t revealed any good efficacy data to merit its $200M+ market cap. Until it does, we can say that the stock should be trading at $100M market cap or below, and will likely reach there within the next couple of months.