Former Top Executive at authID Spills the Beans about its Selfie Identification Product: “There is No Market Fit”

- A former authID (AUID) top executive has told us that selfie identification will never be the second factor of authentication. He says software that tracks the user’s behavior will be.

- The executive said that as hard as the company tried, no sell-side brokerage has ever had an interest in the company or wanted to ask questions on their earnings calls.

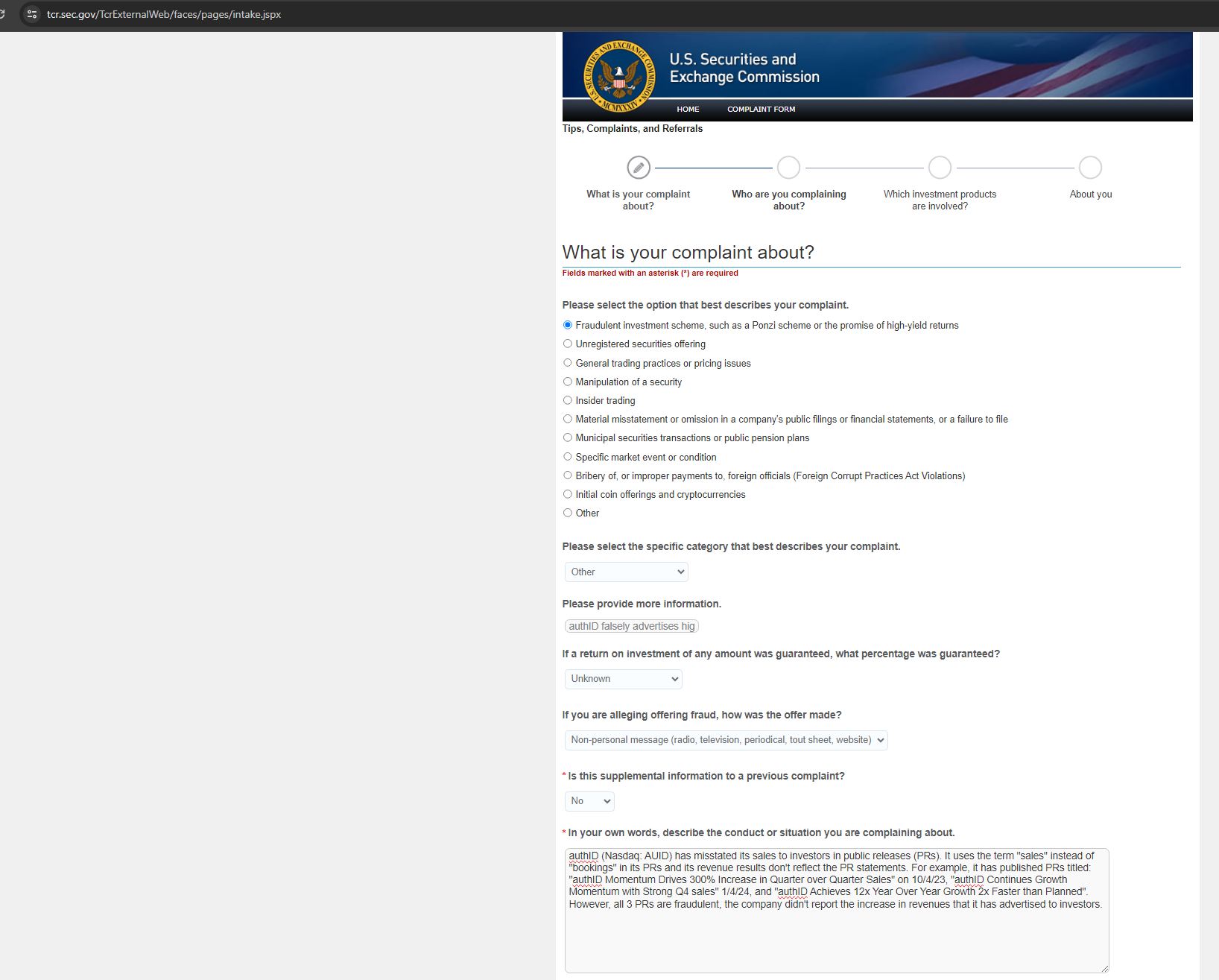

- AUID’s PRs have falsely mentioned to investors a huge increase in “sales”, instead of using the correct word “bookings” which means “possible sales”.

- AUID’s recent Q4 2023 sales results were far below what AUID claimed them to be in PRs. We have reported this false financial advertising to the SEC.

- We believe AUID’s sales will remain tiny, as the company continues to be unable to sell its product to any meaningful company. We have a $1 price target on AUID.

With an egregious price/sales multiple of over 300, significant losses, and a product that it hasn’t been able to sell to a meaningful company for the past 6 years, we find AUID to be grossly overvalued.

A former authID (AUID) top executive who left AUID in 2023, spills the beans about its product.

This executive, who requested anonymity, told us:

There is no product market fit, it’s like showing up to a football game with hockey skates on.

He further stated:

A selfie is never going to be the second factor of authentication. Software on your phone that tracks your behavior will be.

The common method of two-factor authentication is getting a code sent to a second device. This is less personal and easier/quicker than taking a selfie.

Upon further discussion and research, we’ve found that companies aren’t going to make selfies a second factor of authentication because it’s inconvenient, and too personal/invasive. Most people don’t want to take the trouble of smiling into a little window all the time just to log into their account.

A phone that tracks how you move and what you do is less personal and it’s convenient, the user won’t have to do anything extra.

authID’s Uses the Term “Sales” in PRs Instead of “Bookings” – We Have Reported This False Reporting To The SEC

It’s ironic that AUID is supposed to guard against fake logins, yet it provides fake revenue numbers in its PRs. For example, on 10/4/23, AUID released a PR titled “authID Momentum Drives 300% Increase in Quarter over Quarter Sales.”

AUID only earned $44K in revenue in Q323. A 300% increase would have been $176K in Q423.

$176K revenue in a quarter would be pathetic for a $50M+ market cap company. However, AUID couldn’t even accomplish that. It only earned $72K in revenues for Q423.

To release a PR that clearly states that quarter over quarter sales increased 300%, and then not deliver, is a violation of SEC rules and could lead to a fine. On 9/28/23, XL Fleet received an $11M fine from the SEC over misleading investors about its revenue prospects. On 8/4/23, the SEC fined Canoo $1.5M over “unreasonable revenue projections”.

AUID’s PRs should use the word “Bookings” instead of “Sales”. Bookings are when a prospective customer says “maybe we’ll buy this much of your product”. There’s no penalty for a company to change its mind on bookings or cancel it completely.

On 1/4/24, AUID published a PR titled: “authID Continues Growth Momentum with Strong Q4 Sales”

Then it states: “Q4 bookings representing a 64% increase over the Company’s third quarter.” Right there in the PR, the company uses the word “bookings” instead of “sales”. Why not use the correct term, bookings, in the PR title? It’s likely because that sounds weaker and AUID is trying to entice new investors.

authID’s New Reported Customers Won’t Provide Any Significant Revenue

The few recent deals that AUID advertised are from companies that won’t provide much, if any, revenue.

On 11/2/23, AUID announced a new customer, Bieases. Bieases is a seven-person startup that has no customers or revenues. We downloaded the app to test it and we weren’t able to open an account. There are only a couple employees on LinkedIn, including the company’s founder, Bin Lee. We weren’t able to find any reviews on the app or the company anywhere.

On 11/30/23, AUID announced a deal with PickleJar Entertainment (NREG). NREG is an OTC company with its stock trading at below 1c per share, and less than a $1M market cap. It also has practically zero revenues. So how can it pay anything to AUID?

On 4/18/24 AUID announced a deal with the National Notarial Centralized Verification System. This company appears to just have one employee, its CEO Stefan Perez, on Linkedin. It shows Perez has a day job as a notary.

Booked Annual Recurring Revenue (BARR) Isn’t Real Revenue – It’s Bookings

On 1/17/24, AUID released a PR titled: “authID Achieves 12x Year Over Year Growth 2x Faster Than Planned”.

The first paragraph of this PR states: “the Company experienced record year over year growth in sales of 1,200% for its biometric identity authentication platform.”

This is a false statement. The company misclassified sales as “Booked Annual Recurring Revenue” (BARR) which isn’t real sales. The word “sales” is synonymous to “revenue”. Booking is far from guaranteed. AUID even has a disclaimer at the end of the PR stating:

“bARR & ARR should not be considered as predictors of future revenues but only as indicators of the direction in which revenues may be trending. Actual revenue results in the future as determined in accordance with GAAP may be significantly different to the amounts indicated as bARR or ARR at any time.”

We have reported these fraudulent PRs to the SEC, screenshot below:

Source: Sec.gov

Software on Your Phone That Tracks Your Behavior will Be the Future Second Factor of Authentication, Not Selfies, According to authIDs Former Executive

As we showed in our previous bearish report on AUID on 2/17/22, the company has been claiming success with selfie facial recognition since 2018. It still hasn’t caught on today, six years later.

The Executive told us that phones tracking your behavior will be the new second factor authentication, not selfies. Going into more detail, he said:

All software applications that are installed on your phone track your behavior (how you hold it, how you type, where you go, how you walk and so on)… in milliseconds the software can tell if it’s John or someone holding John’s phone. When you as a consumer (for example let’s say a bank) access your bank account, (even if from your laptop as your phone is likely next to you and you’ve been using it minutes prior) a quick check can ask the software on the device, is the behavior exhibited from it recently John. If the answer is yes, the transaction is approved. This is because statistically this behavioral check is as telling as sending you a 6-digit pin or asking you to take a selfie.

Banks (and all enterprises) hate making their consumers take an active action that is not directly related to executing a transaction as sometimes the extra step (PIN codes or selfies) cause you to put the phone down and not finish the transaction as it drives the buzz word “abandonment”… authID was trying to replace Twilio and the PIN code when I was there, and that market is just not there… if you listen to Rhon’s WSJ podcast he clearly is talking about different use cases and we’ll see how successful that will be.

From the WSJ podcast, published on 2/9/24:

Rhon Daguro: It’s absolutely the chip.

Danny Lewis: As in putting a chip inside your body that gives you up to the second data about everything, from glucose levels to the effect of medications.

Rhon Daguro: The number one use case for a chip is really to get the vitals of yourself. We’ve created all these external sensors on our bodies to be able to do this thing to be more convenient. Then I think the next evolution is to be able to just use it to interact with your digital environment or your physical environment.

Similar to what Executive said, Daguro referring to a chip seems to suggest that your physical movement will become used more as an identity check in the future.

Conclusion

Selfies as a second factor of authentication has never caught on, even after being around for over 10 years. We expect AUID revenues to remain very small, as they have been. We have a $1 price target as upcoming negative catalysts sour investors on the stock. With currently about 10M shares outstanding, a $1 price target would give a $10M market cap. Even if AUID manages to get to $500K in revenues per year, that would still be a large P/S ratio of 20.

An equity raise, SEC investigation, disappointing revenue numbers, and insider sales are upcoming catalysts that could cause the stock price to decline.