Mega Matrix Corp’s Recent Acquisition, FlexTV, Appears To Already Be Its 5th Consecutive Business Failure – 50c Price Target

- Mega Matrix Corp (MPU) entered a letter of intent to acquire 60% of FunVerse (the owner of FlexTV) on 11/15/23. At 75c, where MPU closed on 11/13/23, that puts the investment at a value of only $1.125M. Yet MPU’s market cap is currently over $100M.

- FlexTV is a streaming app that has a format of 1-3 minute drama clips.

- All of MPU’s previous businesses failed and have been abandoned, so its value is solely dependent on FlexTV.

- MPU’s history of failure: MPU went from a US aircraft leasing business in 2021, to an NFT gaming business, to a Metaverse company, to a digital staking company, to now a short drama streaming company. Every single business MPU has attempted has been a failure so far. FlexTV appears to be following this trend.

- MPU’s crypto business failed during the recent crypto boom. This suggests management incompetence.

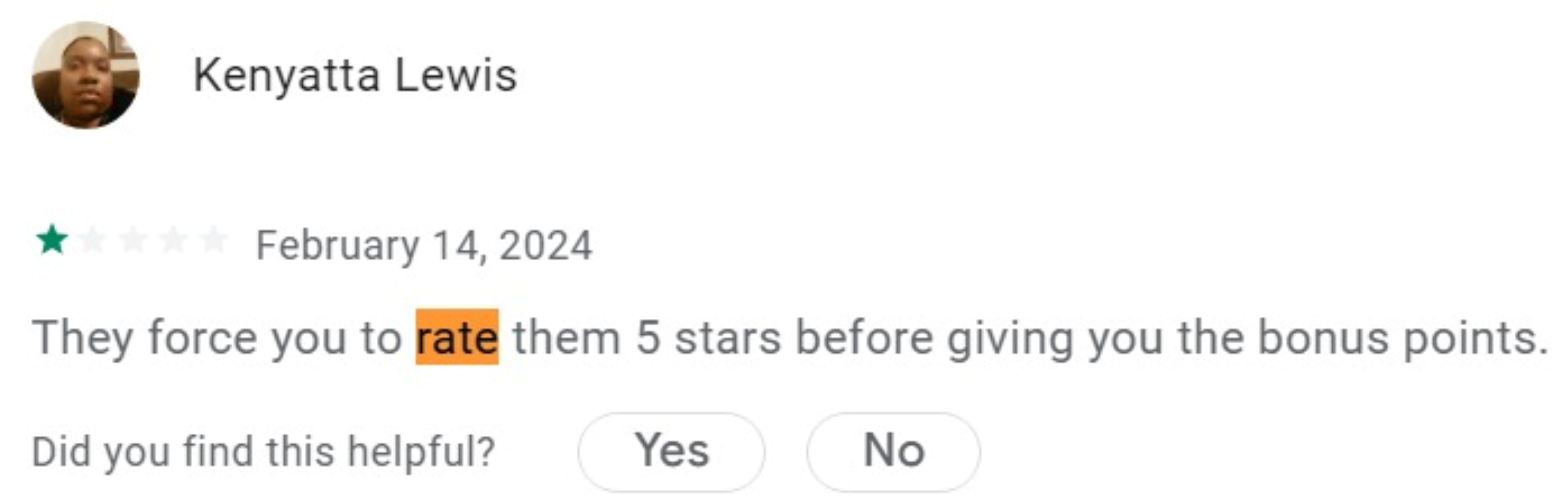

- MPU management has shown to not be forthcoming, highlighting FlexTV promotional articles without disclosing they were paid for by the company, and paying users with FlexTV virtual coins to leave 5-star reviews for the app.

- Despite the company’s repeated incorrect claim that it’s in the top 10, FlexTV’s popularity is low as it currently isn’t even in the top 100 free apps on the iPhone Apple Store or Google Play, whereas 5 of its competitors are recently in the top 25 on the Apple Store.

- With a slew of competition, including TikTok, YouTube and many short drama streaming apps, we believe the chance of FlexTV’s failure is high.

- The short drama clip market was already hot before MPU’s acquisition of FlexTV. This suggests MPU is entering another hot market to entice investors for dilution instead of displaying any great foresight to business trends.

- MPU’s management doesn’t have any entertainment or media experience, including a recent strange new hire. Therefore, there’s no value added or synergy to its FlexTV acquisition. What is management even doing with their time now?

- The short drama leader, ReelShort, only made around $22M in revenue in 2023. FlexTV gets a fraction of the views that ReelShort gets.

- We think the name “FlexTV” doesn’t fit the short drama genre. This misname will likely hurt the company’s ability to brand itself and attract a bigger audience.

- This is an undiscovered short opportunity with the annual borrow rate only about 3%.

- We have a 50c annual price target on MPU, which would give it a generous market cap of about $20M.

Mega Matrix Corp (MPU) has risen over 100% since early January 2024 based solely on its new endeavor – acquiring a stake of FunVerse which owns FlexTV. FlexTV is a “short drama” streaming service. It shows 1-3 minute clips of shows at a time. We believe MPU is massively overvalued, as its other assets are practically worthless, and it has gone through a series of business failures since 2021. We believe FlexTV will be the company’s next failure. With the short selling borrow rate of only about 2%, we believe MPU is a good short candidate to hold long term to wait for FlexTV to have unsatisfactory results. We believe the stock price will fall to 50c within a year.

MPU announced on 11/15/23 that it entered a non-binding Letter of Intent to make a 60% acquisition of FunVerse and the stock jumped to a little above $1.00. Funverse owns FlexTV. On 11/13/23, MPU closed at 75c, so 1.5M shares would put the valuation of MPU’s stake of FlexTV at only $1.125M. In our opinion, if FlexTV had a real competitive advantage then it wouldn’t have been sold for dirt cheap like it did.

MPU was trading between $0.65-$1.50 from September through December 2023. On 1/8/24, MPU announced that it successfully closed the acquisition of 60% of FunVerse. Upon the news, the stock more than doubled, as shown in the 12-month chart below:

Even If FlexTV Becomes A Semi-Successful Investment, MPU Is Still Massively Overvalued

MPU acquired its shares of FunVerse for a total of about $1.125M, yet its market cap is around $90M at $2.50 per share. Additionally, on 1/12/24, MPU entered a private placement with investors and sold 2.5M shares for $1.50 plus 2.5M warrants at a $1.50 exercise price. The warrants haven’t been registered yet.

At $2.50 per share, the additional 2.5M shares from the warrants would add another $6.2M in market cap, making the total share count about 38.5M, to have a total market cap of around $96M.

Even if MPU realizes a 10x return on its FunVerse investment, valuing it at $12M, that would still suggest that the stock is overvalued by many multiples. MPU’s other assets are worth close to zero.

FlexTV is showing signs that it won’t be successful, making the stock even more overvalued today, likely having an intrinsic value below 50c per share.

All Mega Matrix Corp’s Other Businesses Besides FlexTV Have Failed

MPU’s Q323 10-Q, for quarter ended 6/30/23, states:

Accordingly, for the three and six months ended June 30, 2023, the Company had two business segments which were comprised of 1) the newly launched ETH staking business, and 2) the leasing of regional aircraft to foreign and domestic regional airlines.

First, let’s take a look at MPU’s aircraft leasing business. The revenues were historically near zero over the past two years, and besides that, the 10-Q states that MPU discontinued this business on 8/24/23.

On 3/18/24, MPU provided a business update. The update stated that MPU has ceased its crypto-related staking business. Even in a crypto environment as hot as it is now, MPU wasn’t able to succeed in it. The only business MPU now has is FlexTV.

In its 2023 10-K, MPU reported about $10M of liquid assets, including digital assets on 12/31/23. Adding $7.5M in the recent offering and assumed exercised warrants at $1.50, that puts the cash balance at around $15M, assuming $1-$2M in cash burn for last quarter.

FlexTV Isn’t Even In The Top 100 Free Entertainment Apps On The Apple Store Or Google Play – But Its Competitors Are

FlexTV is not popular on the app stores, contrary to what MPU has repeatedly claimed. This is a sign that FlexTV is already a failure.

On 1/22/24, MPU published a PR titled:

Mega Matrix Announces FlexTV’s Surge Into Top Ten Free Iphone Entertainment Apps (US)

The PR is written like MPU is proud of this accomplishment, as it states:

“FlexTV’s rise to the top ten free entertainment app in the Apple App Store is a testament to the platform’s popularity and user engagement.”

Then, in a 3/1/24 PR, a 3/8/24 PR, and a 3/18/24 PR, MPU continually mentions FlexTV’s top ten spot:

“Following FlexTV’s rise to 8th position in the U.S. Apple App Store’s entertainment category (US) in January 2024…”

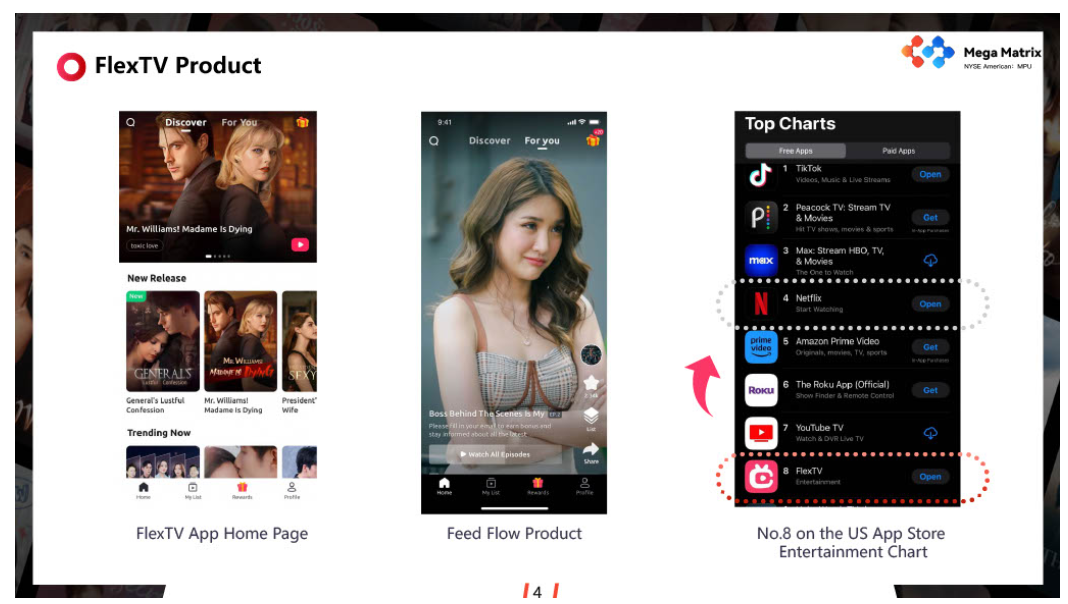

In MPU’s investor presentation, on 4/3/24, the company misleadingly mentions on page 4 that it’s ranked number 8, screenshot below:

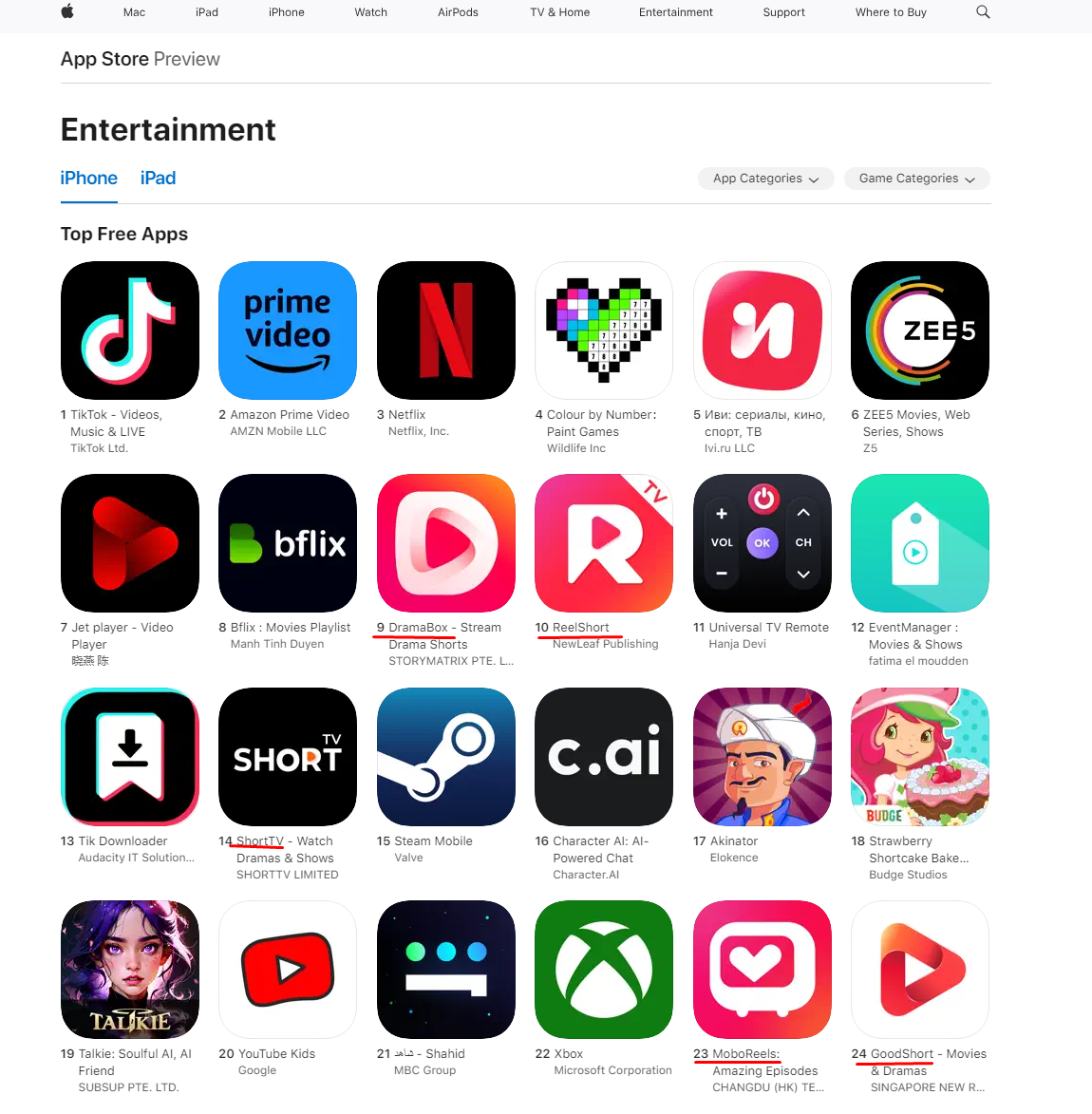

However, this top ten placement was temporary. Currently, checked on 3/31/24, FlexTV isn’t even ranked in the top 100 Free Entertainment Apps on the Apple Store or Google Play. But many of its competitors are there and staying there, such as ReelShort, DramaBox, ShortTV, GoodShort, and MoboReels. As shown in a screenshot of the Apple Store’s top entertainment apps below (checked again on 4/2/24):

Source: Apple App Store

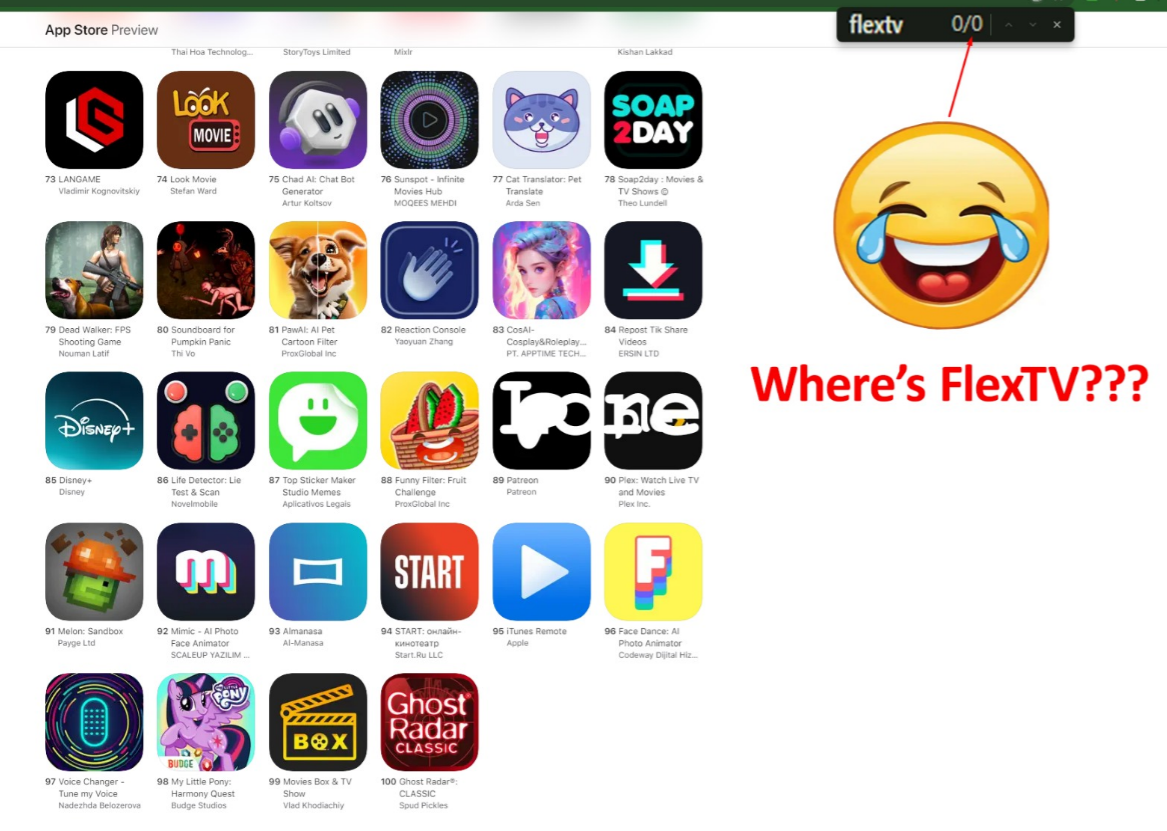

FlexTV is nowhere to be found among the Apple Store’s top 100 apps:

Source: Apple App Store

Mega Matrix Peculiar Recent Hire And News

There’s been some strange company promoted news and hires from MPU. On 3/22/24, MPU announced the hiring of Songtao Jia as its Chief Strategy Officer. But his history is in technology, specifically for Lucent Technology. He hasn’t appeared to have experience in entertainment, which MPU is now with FlexTV. MPU’s management doesn’t have any experience in entertainment or media, so we don’t see how it can add any value to FlexTV.

Compare to COL Group, a publicly traded Chinese company (SHE: 300364) which owns ReelShort, whose management has a history with media and entertainment. As stated on COL Group’s website:

“COL primarily focuses on literature IP, and creates a wide range of derivative forms of excellent web fiction, such as audiobooks, short and medium drama series, animation, film, and merchandise. COL has adhered to the “authorization before dissemination” principle and has set up a top-notch professional intellectual property protection team.”

Compare that to MPU’s website, which doesn’t say anything of the sort and they have no IP because the management has no experience in this industry.

On 3/7/24, MPU announced the publishing of an article from the MIT Technology Review highlighting FlexTV. It’s interesting that the article mentions FlexTV over more prominent short drama streaming companies. But then if you scroll to the bottom of the help section on the website, it says: “Elevate your brand…From event sponsorships to custom content” as shown below:

Source: MIT Technology Review

This suggests MPU paid MIT Technology Review and helped write the article. The article has some quotes from Xiangchen Gao, which it says is the “chief operations officer of FlexTV”.

But this isn’t true. As stated in its 2023 10-K, MPU hired Gao on 1/18/24 as Chief Operating Officer of MPU. Before that, it states that he worked for Digital Element Co. from 2022 to 2023. He never worked for FlexTV.

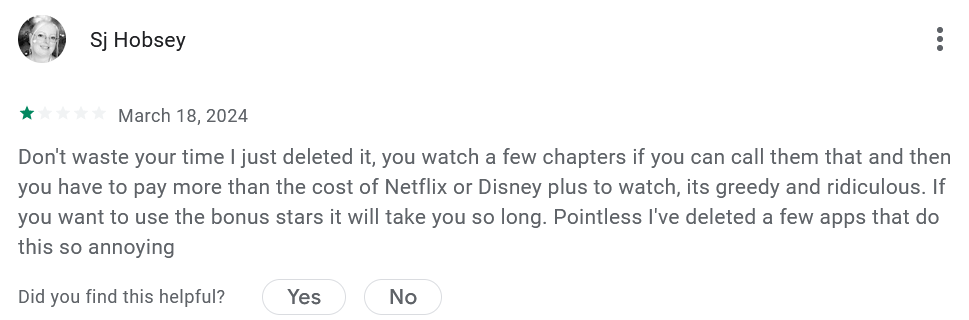

FlexTV Pays Customers To Leave 5-Star Reviews, So They Should Not Be Believed

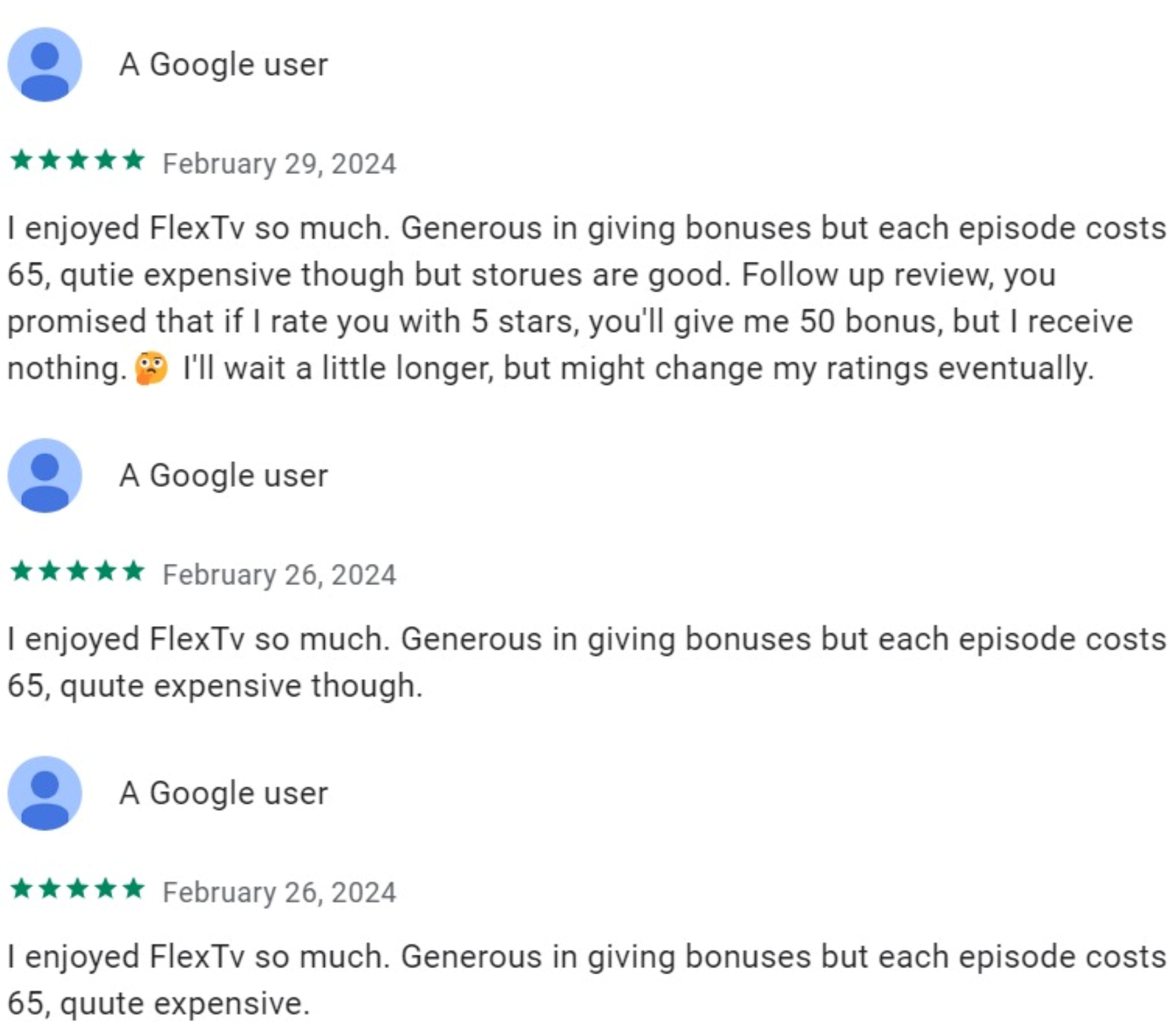

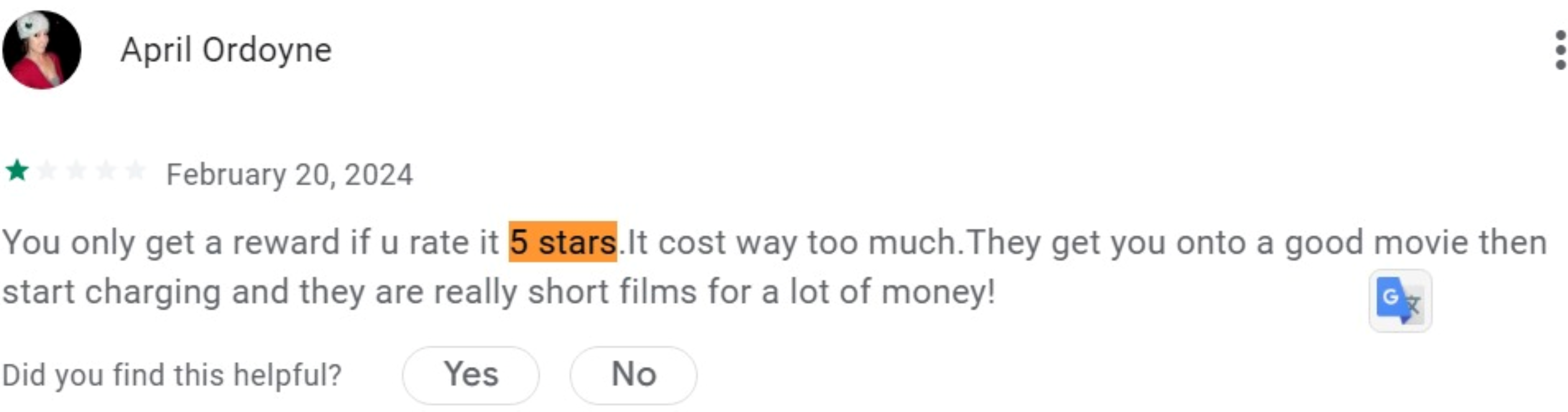

FlexTV has a large amount of online reviews. A few days it has over 100 reviews. We’ve found that MPU cares a lot about having users leave good reviews. To the point that they offer free virtual coins to watch the videos for leaving a 5-star review. Paying for reviews is a dishonest practice that shows the level of desperation the company has to make itself look good instead of having the content speak for itself. The current company’s average rating should not be believed.

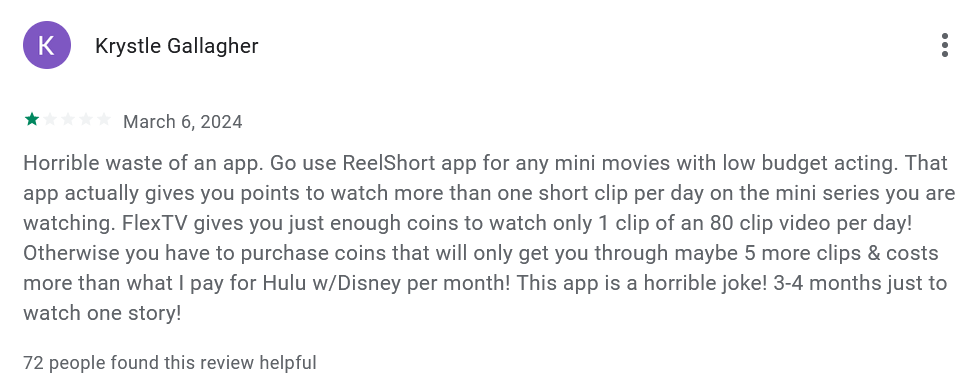

The following are some of the more descriptive reviews from Google Play:

These reviews show that FlexTV pays for 5-Star reviews:

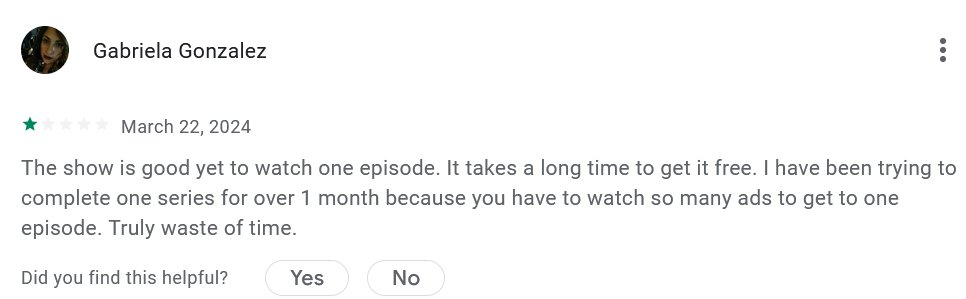

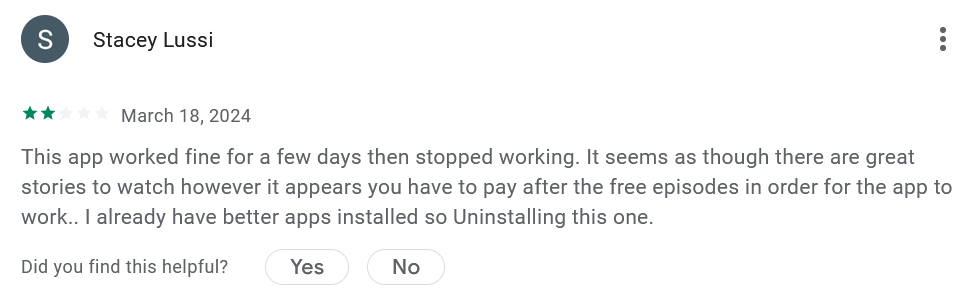

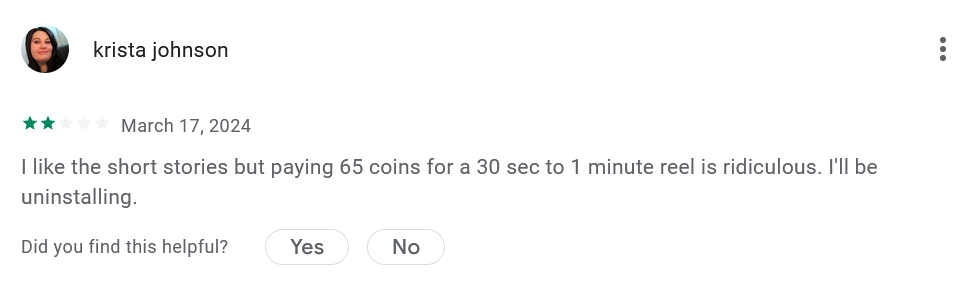

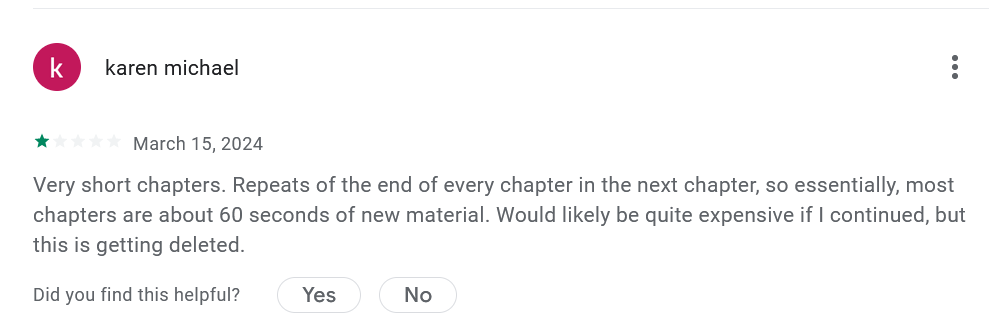

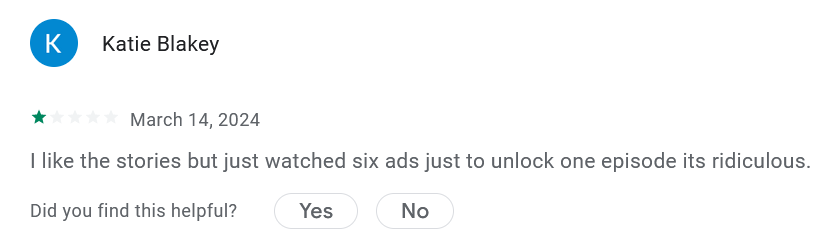

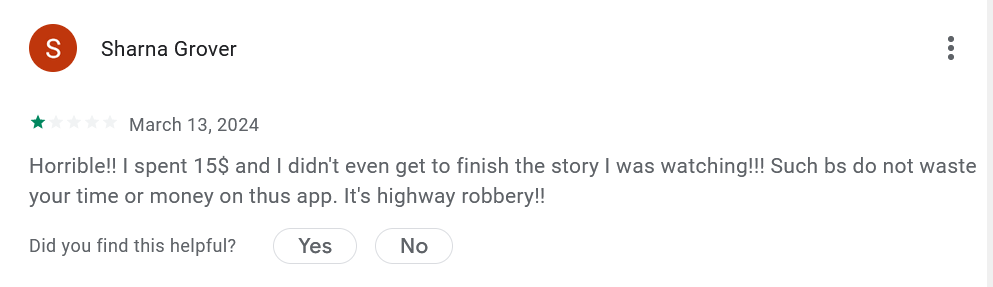

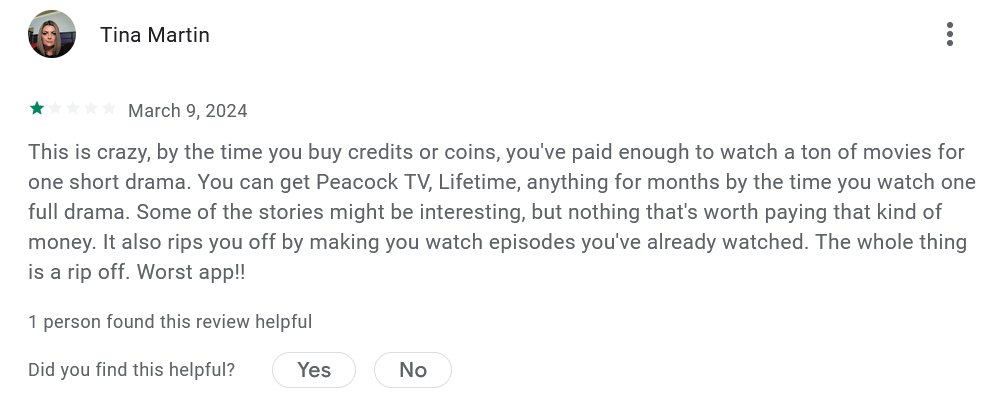

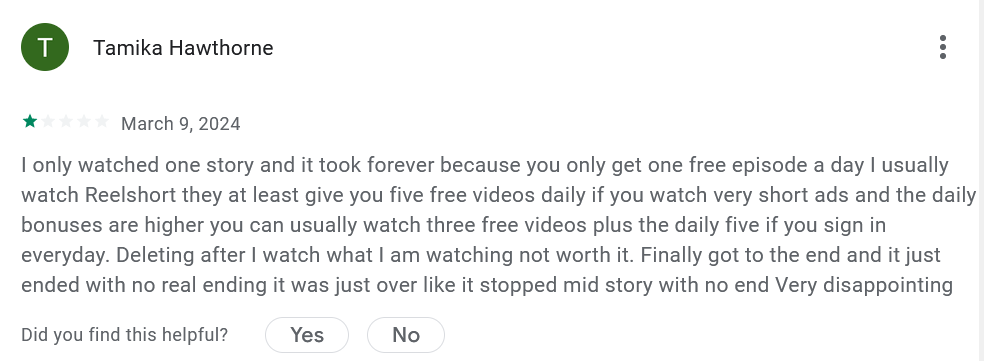

The following reviews show users major complaints of the app:

The following FlexTV reviews are users saying that ReelShort is a better streaming service:

The reviews also reveal that many users are complaining about how expensive FlexTV is or that you have to watch too many ads. These types of complaints are similar looking at the reviews of FlexTV’s competitors. Which suggests there will be a “race to the bottom” with all the competing short drama companies reducing their prices.

FlexTV’s Name Doesn’t Make Sense

We don’t believe the name of the app, FlexTV, makes sense. It’s a short drama app, so why call it “Flex”? We think the misname will hurt FlexTV’s ability to brand itself as one of the short drama leaders.

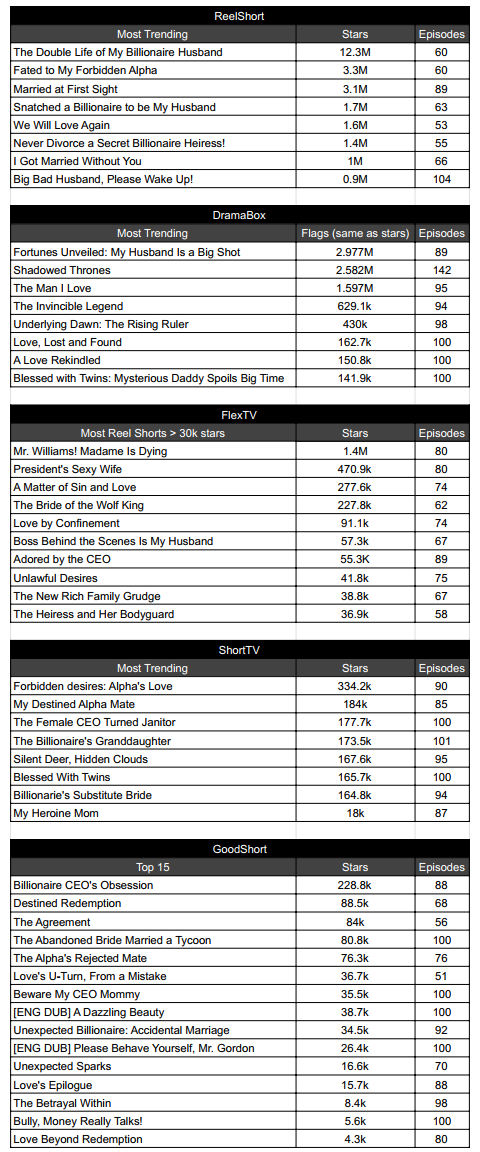

A Look At The Number of Stars Per Series For FlexTV and Competitors

The number of stars is found by downloading each app, and it shows the stars when you open each show. Here’s a table showing the amount of stars for the top short drama apps for each of their series:

Note: short drama competitors weren’t included that don’t have the same star system.

As shown above, most of the shows have similar titles. Mostly about successful, elite men like CEOs and billionaires. By far, ReelShort is the market leader with the most stars. FlexTV has one hit show: Mr. Williams! Madame is Dying. But it will fade in views over time and FlexTV will have to continually create more hit shows to keep its customers.

ReelShort, The Short Drama Leader, is trying to grow in North America

ReelShort (a Chinese company partially owned by COL Group) is the market leader for short drama apps. COL Group went into creating short dramas specifically for short-form content platforms in a vertical format. This WSJ article, published on 12/26/23, states that ReelShort was created and owned by Crazy Maple Studio. COL Group owns 49% of Crazy Maple Studio.

This article, titled Flash Fiction TV: Why China Is Betting Big on Ultrashort Dramas, published on 1/24/24, states:

“China’s ultrashort drama industry looks to capitalize on the rapidly growing popularity of the genre in international markets.

Leading the charge abroad is ReelShort, a Chinese short drama app, which outperformed TikTok in downloads across the U.S. last November. The app amassed almost 19 million global downloads across all platforms in 2023 and generated more than $22 million in revenue.”

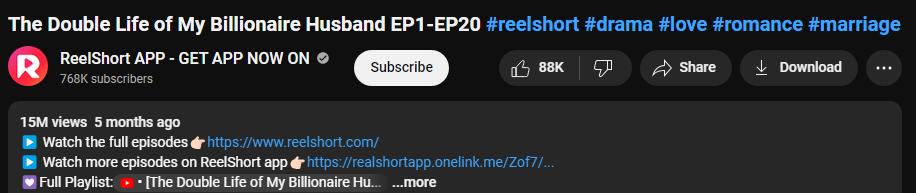

Short dramas primarily target female audiences, with ReelShort reporting a 75% female viewership. ReelShort posts some episodes of its short-form drama on TikTok and YouTube, e.g., “The Double Life of My Billionaire Husband”. Notice that free episodes 1-20 got 15M views on YouTube, and it promotes the app. Screenshot below:

Source: YouTube

However, ReelShort only posts a few episodes on those platforms as a teaser, and the rest requires downloading the app and paying. Users pay up to $10 or $20 to continue watching, with each series comprising 60-80 episodes lasting 1-3 minutes each.

Compared to FlexTV, one can see the entirety of its #1 movie: “Mr. Williams! Madame is Dying” on YouTube and TikTok. Here, you can watch the entire movie on Daily Motion. As that show gets older, it will get less and less views, and FlexTV will have to create another top show which will cost a lot to make a quality one.

What is happening here is that China is doing what it’s best at: mass-producing something at the lowest cost possible, at the expense of quality. In Hengdian, the epicenter of China’s movie industry, many production studios have turned their attention to churning short dramas. Up to 300 crews might be shooting short dramas around Hengdian, south of Shanghai, on any given day. Other companies are trailing behind ReelShort to get into North America.

Conclusion

Before being acquired by MPU in January, FlexTV wasn’t doing well and still isn’t even in the top 100 free entertainment apps of the Apple Store or Google Play. On 3/8/24, MPU announced it plans on making a significant investment of $100M over three years for content creation. A question that investors should ask is how will MPU raise the $100M? The company is currently low on cash. They just did an offering on 1/12/24 at $1.50 per share, and that was a couple months after announcing they intended to acquire a majority ownership of FlexTV. Can investors expect MPU to do much more dilution at $1.50 per share? That would likely significantly depress the stock price from its current price of around $2.50-$3.00.

With already a lot of seasoned competition, MPU seems late to the short drama game. If it had gotten in before the market got saturated, it would show that management has good foresight. However, at this point entering an already saturated market suggests that MPU is still just looking for hot markets to entice investors. If history is a guide, MPU will likely fail at making FlexTV a success just like the four companies before it, and then move on to its next acquisition. Furthermore, why would you name a short drama streaming app “FlexTV”? It doesn’t fit the genre.

We believe a one-year 50c price target for MPU is appropriate. The fully diluted share count is about 38.5M shares. At 50c, that would put the market cap at close to $20M, assuming significant cash burn. That’s a generous valuation to put on a lower tier short drama streaming app that MPU acquired their stake in for only a couple million dollars in stock.