- ZJK Industrial (ZJK) is a Chinese precision fastener company (it makes nuts and bolts), it’s not an AI or liquid cooling system company.

- ZJK claims to have a collaboration with Nvidia to manufacture liquid cooling systems, and is an “approved vendor”. Our evidence shows that this is false – there’s no connection whatsoever between the two companies.

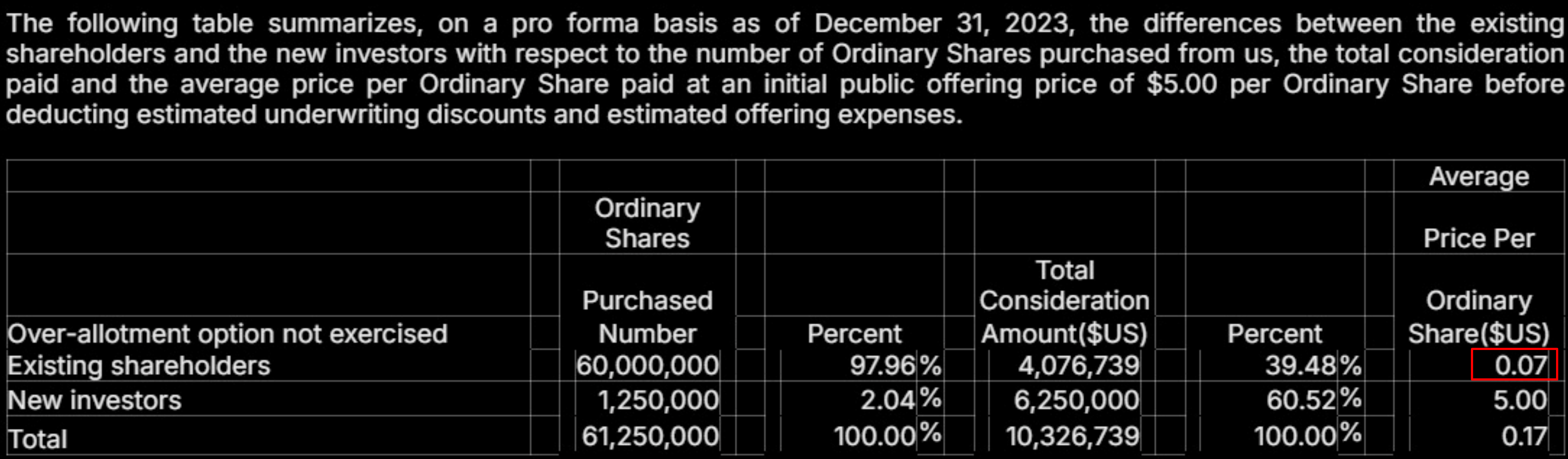

- Pre-IPO investors, which include related parties, were able to buy 60M shares at 7c apiece. The lock-up expiry is on 3/31/25.

- Nvidia doesn’t assemble liquid cooling systems itself, it buys the whole thing from companies like Vertiv or CoolIt Systems, therefore would have no reason to collaborate with a nuts and bolts company like ZJK.

- Google Maps reveals that ZJK’s North American office is a residential house, which suggests they have little to no business in North America.

- Nvidia investor relations responded to our inquiry and confirmed that they have no partnership with ZJK.

- ZJK’s intention to pump the stock Is apparent as they magically became an AI company overnight with their nuts and bolts.

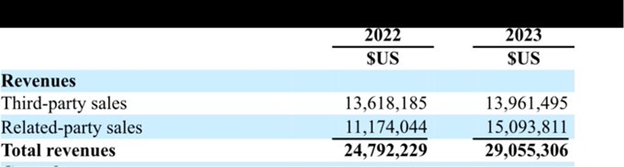

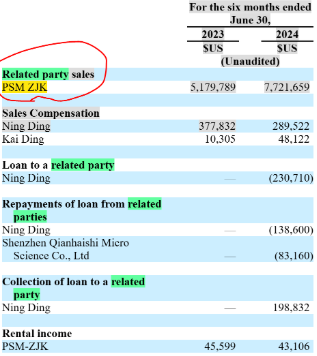

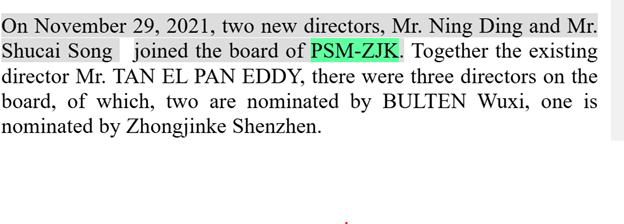

- Over 50% of ZJK’s revenue is from a related party, their subsidiary, with almost the same name, PSM ZJK. There could be some round tripping of cash to artificially inflate revenue with related parties and what ZJK claims to be “investments in subsidiaries”.

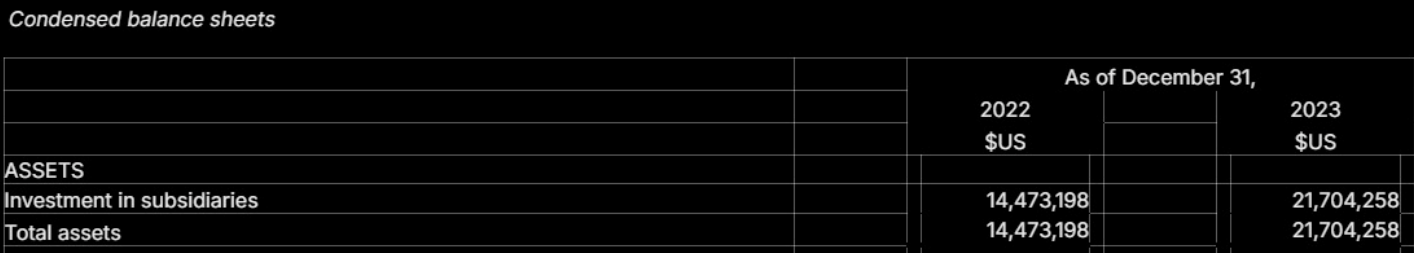

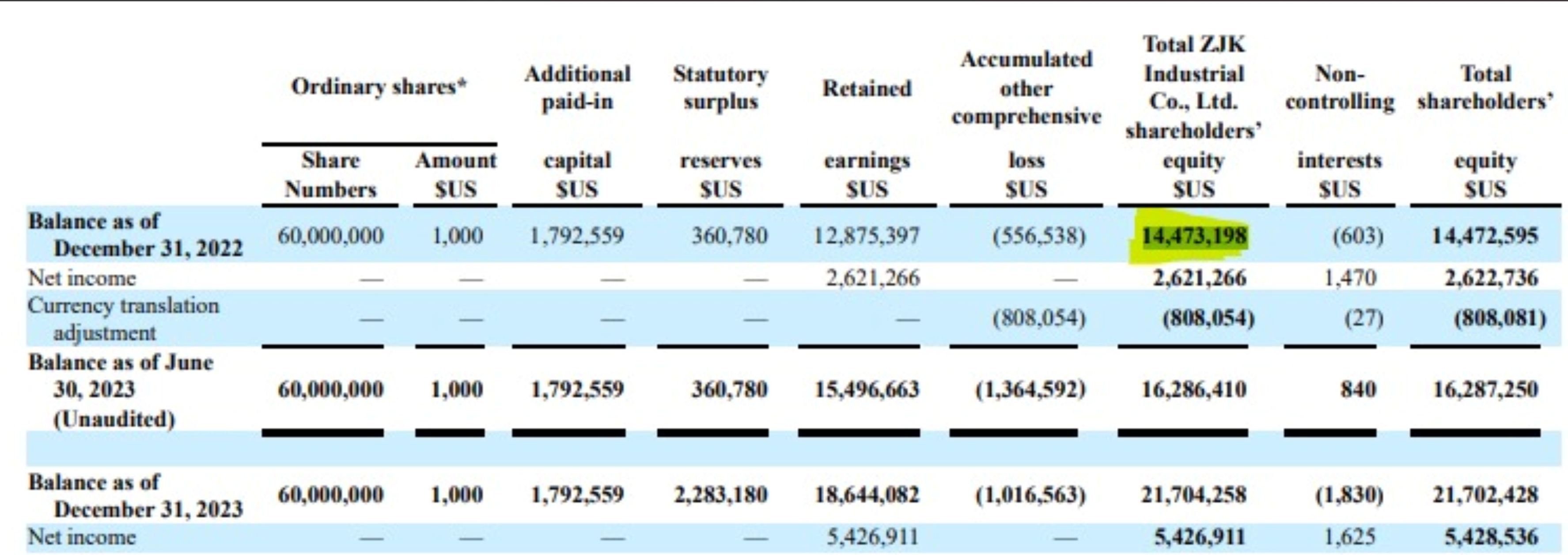

- ZJK reports “Investments in subsidiaries” as the same number as its stockholder’s equity, which is strange and could be an accounting/auditing error.

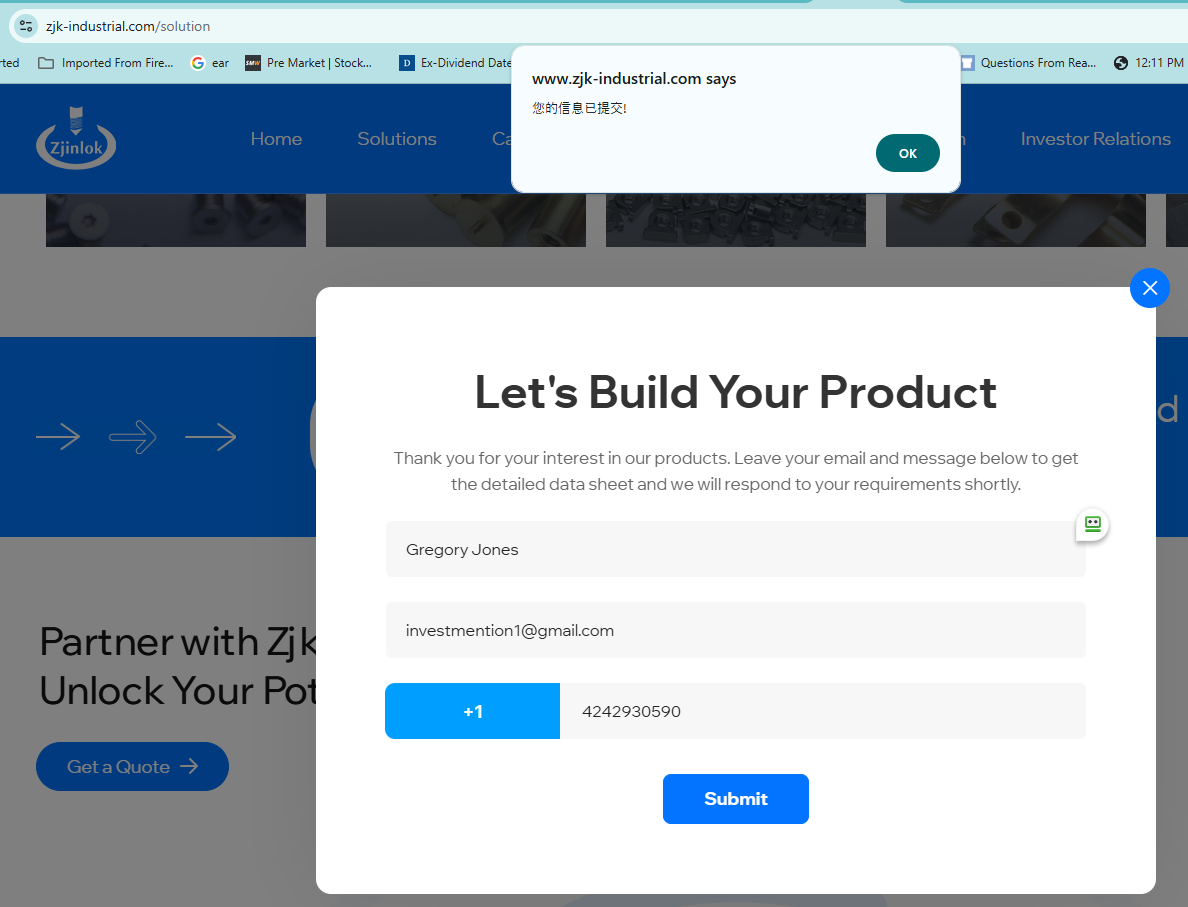

- ZJK doesn’t respond to emails from investors or requesting a quote from its website, we’ve tried 5 different emails and didn’t receive an answer from any.

ZJK Industrial (ZJK) is a company based in China that manufactures and sells nuts and bolts and other precision metal parts. It’s a simple, boring business, not a rapidly growing tech or AI company. ZJK got on a US exchange and is trying to create the perception that it’s aligned with the AI sector to get investors excited and earn a much higher multiple than it deserves. Then the insiders can cash out for a huge windfall.

ZJK is similar to ZK International (ZKIN), in more ways than just the name. ZKIN is a Chinese company that also has a simple, boring business manufacturing and selling steel pipes in China. It has dabbled in cryptocurrency businesses and online gaming which temporarily dramatically boosted its stock price. Those other businesses failed, now it only has its core steel pipe business. ZKIN recently did a reverse split and is close to being delisted. We actually published a bullish report on ZKIN as a sector play during the crypto mania in early 2021.

50% of ZJK’s revenues are from a related party in which ZJK has a 49% stake, and the CEO is on the board of directors. This is a subsidiary, so these revenues likely aren’t worth much.

They had their IPO on 9/30/24 at $5 per share. The stock hovered around that place for a couple months. Then, on 12/3/24, ZJK went parabolic and closed over 100% higher after the company published a PR titled: ZJK Industrial Expands Collaboration with NVIDIA into Liquid Cooling Systems.

The PR stated:

Following a recent meeting at NVIDIA’s Santa Clara headquarters, ZJK Industrial received a request to produce samples for one of NVIDIA’s upcoming liquid cooling manifold projects. The expansion of the cooperation reinforces ZJK Industrial’s position as one of the select, approved vendors for NVIDIA’s liquid cooling systems

Our evidence shows that ZJK has NO cooperation with Nvidia and is certainly not a Nvidia approved vendor.

ZJK’s North American Office Is a Residential House

From ZJK’s website, it shows that its North America office is at 142 Ravine Drive, Port Moody, BC, Canada, screenshot below:

Source: ZJK Website

Checking the address on Google Maps, it shows that it is simply a residential house, not an office, screen shot below:

Source: Google Maps

The fact that they don’t have a commercial office in North America suggests that they have little to no business there. ZJK states in their IPO prospectus:

“We have both China-based and overseas sales teams in North America, and we expanded our business in North America through entering into sales representative contracts with 7 sales representative teams who will sell and promote our products in North America. In addition, the Company has established a factory in Vietnam in April 2024 and plans to open a sales office in the United States in early 2025 to further expand the market.”

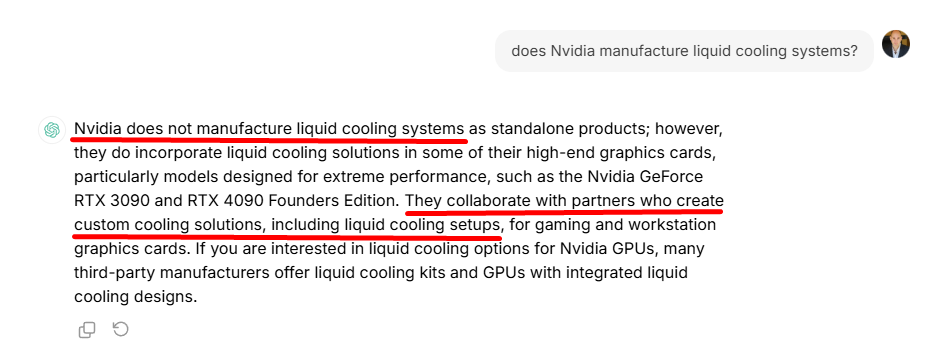

NVIDIA Doesn’t Manufacture Liquid Cooling Systems, Therefore Wouldn’t Directly Buy ZJK’s Parts

As stated earlier, ZJK is just a nuts and bolts company. They don’t manufacture liquid cooling systems. Nvidia doesn’t manufacture liquid cooling systems either. Therefore, they have no reason to collaborate or partner with ZJK. Nvidia buys entire cooling systems from companies that make the whole thing like Vertiv and CoolIT Systems. They aren’t going to purchase small parts from a bunch of different small companies like ZJK and assemble a liquid cooling system themself.

This is confirmed by asking ChatGPT:

Source: ChatGPT

It says above that Nvidia collaborates with partners who “create custom cooling solutions”, not partners who create individual parts like ZJK.

If ZJK really cared about expanding into North American companies, instead of trying to name-drop Nvidia to boost the stock, they should be talking with companies that actually manufacture liquid cooling systems like Vertiv, and try to sell them their nuts and bolts.

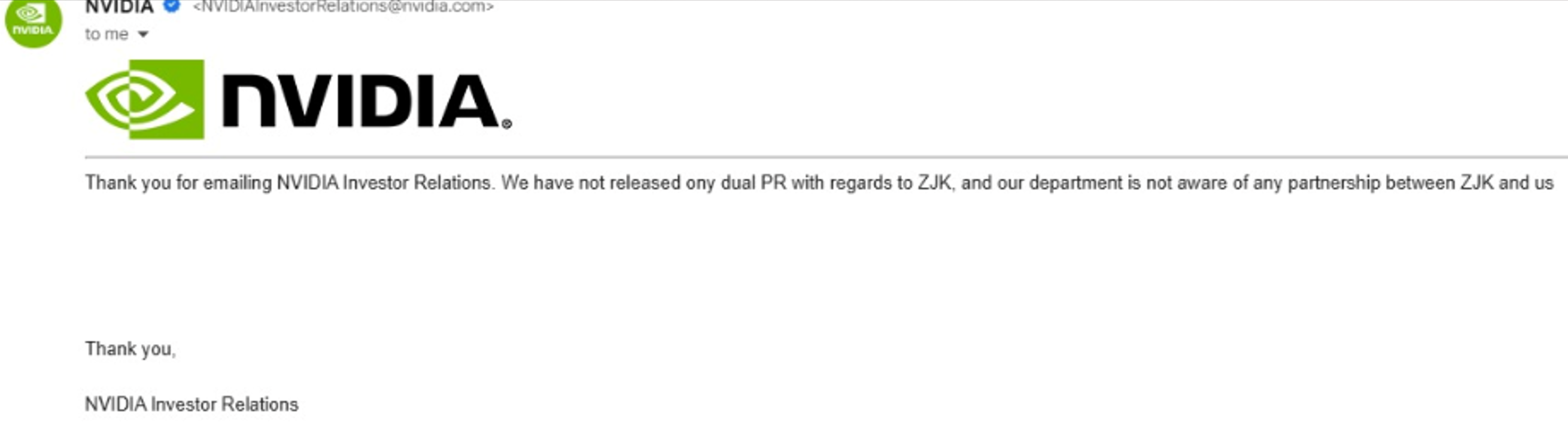

We Emailed NVIDIA Investor Relations Who Responded That They “Have No Partnership” With ZJK

Our analyst inquired to Nvidia investor relations if anyone from Nvidia has ever heard of ZJK Industrial because they claimed that they are a partner in the liquid cooling segment, even though it has long been established that Vertiv is Nvidia’s liquid cooling partner. The following was their response:

“Thank you for emailing NVIDIA Investor Relations. We have not released any dual PR with regards to ZJK, and our department is not aware of any partnership between ZJK and us.”

Thank you,

NVIDIA Investor Relations

Screenshot of email below:

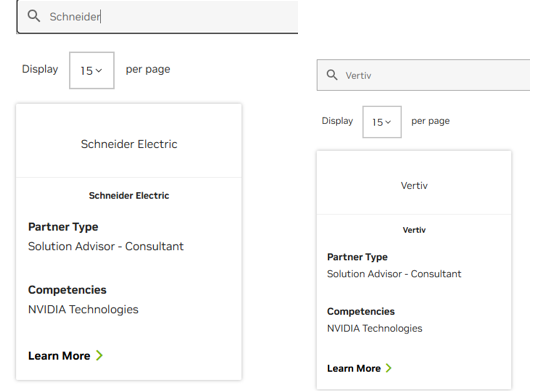

ZJK Is Not In NVIDIA’s Official Partner Network

Nvidia has a Partner Network Locator that allows us to search for its enterprise partners. For example, if we search for Nvidia’s actual liquid cooling partners like Vertiv or Schneider Electric, we get the following results:

A search for ZJK comes up empty, shown below:

Here’s a recent example of a company announcing its partnering with Nvidia for liquid-cooling technology. On 10/15/24, CoolIT Systems issued a PR announcing it, screenshot below:

Nvidia Always Provides A Quote For A Company’s PR That Announces They Are Working Together – Not The Case For ZJK’s PR

This just goes to show the disconnect between Nvidia and ZJK. ZJK’s Press release did not include any quote from Nvidia’s previously mentioned, while Coolit’s PR about its partnership with Nvidia on cooling systems did involve a quote from NVDA’s Santa Clara HQ:

“The expansion of CoolIT Systems’ liquid-cooling product line and manufacturing capabilities in support of NVIDIA Blackwell will help meet the growing demands of data centers, allowing for the creation of more powerful, efficient systems capable of handling the most intensive AI workloads,” said Jeremy Rodriguez, Senior Director of Data Center Engineering at NVIDIA.

This is standard practice from Nvidia when there are any legitimate announcements of companies working with Nvidia, as far as we have observed. But the fact that no one in Nvidia’s IR department knows of any dual press release or connection with ZJK tells us all we have to know.

ZJK’s Intention To Pump the Stock Is Apparent As They Magically Became An “AI Company” Overnight

Looking at the products page today on ZJK’s website, screenshot below:

Source: ZJK Website

Above you can see ZJK’s products: screws, bolts, nuts, etc. They look simple, and they are. Certainly not “AI components” as ZJK claims. It also claims above that Nvidia is a client which we have shown isn’t true.

Using Wayback Machine, we see how ZJK’s website looked before the AI boom. The following is a screen shot of the website from 4/14/24 from Wayback Machine. Under the ‘Applications’ section, we do not see AI or liquid cooling anywhere-Just the buzzwords of 2023 like “aircraft manufacturing” “new energy” “Intelligent wear”. Screenshot below:

Source: Wayback Machine

Even Jim Cramer Has The Incorrect Belief That ZJK Has A Connection to Nvidia

During a “Lightning Round” segment of Mad Money, a caller asked Jim Cramer about ZJK, to which he responded:

“I know because of the NVIDIA connection. I have to tell you, they have flat revenues for the last three years – sounds a little like SoundHound. I’m going to take a pass on that one.”

There’s a big difference between ZJK and SoundHound (SOUN). SOUN is an actual AI company while ZJK just makes fasteners.

On 3/11/25, ZJK drew attention to being mentioned on the show with a connection to Nvidia. The company responded to Cramer’s statement in a PR, stating:

“While we appreciate the opportunity to be featured on Mad Money and understand the fast-paced nature of the program, ZJK has achieved more than 33% average annual growth over the past three years which is far from ‘flat’ by any financial metric, as Mr. Cramer suggested,” said ZJK CEO Ning Ding.

One of the other key takeaways is the desperation seen to pump the stock- they went out of their way to correct a 30-second clip of Jim Cramer’s Mad Money! Also, the perceived ‘growth’ is mainly due to related parties and nothing else.

Pre-IPO Shareholders Own 60M Shares of ZJK That They Paid 7c Apiece Which Can Be Sold After The 3/31/25 Lock-up Expiry

The Lock-up expiry for ZJK is six months after the IPO, on 3/31/25, as stated in the IPO prospectus. Also stated in the prospectus is pre-IPO investors have 60M shares that they acquired for 7c apiece, a fraction of the current price. This is shown below:

Source: ZJK IPO Prospectus

In less than 2 weeks, all 60M shares will be eligible to be sold into the market. We expect there to be a bloodbath with this many shares, that insiders got for practically free.

Note there are about 10M shares from pre-IPO investors who owned less than 5% of the outstanding shares that aren’t subject to the 6-month lock-up restriction and are eligible to be sold right now.

None Of Our Investor Or Business Inquiries To ZJK Have Been Answered

We have tried to get in touch with ZJK to ask questions about their business and “collaboration” with Nvidia, but to no avail. We haven’t gotten any responses at all.

We wrote a basic email stating:

Hi ___________,

I am an investor in ZJK. I have some questions about the company, who can i speak to?

Best,

Ryker Jones

We wrote the above to the following ZJK investor relations emails:

ir@zjk-industrial.com

None of them responded. To us, this shows ZJK’s avoidance of investors who would actually like to learn something deeper about the company. We implore readers to ask themselves- is this really a legitimate company if you can’t even reach them?

We also tried several emails and phone numbers on ZJK’s website and could not reach the company whatsoever.

Including the following product info request on the company’s website:

Source: zjk-industrial.com/solution

We tried several contacts at different times, and never got a response.

ZJK’s Revenue Growth Comes From Related-Party Sales – Its Subsidiary PSM ZJK

Most, if not all, of ZJK’s revenue growth stems from related party transactions:

As stated, ZJK is a rudimentary screw maker. Their related party customer literally has the name ‘ZJK’ in it:

Source: SEC filings

ZJK has an equity investment in PSM ZJK, and also, the CEO of ZJK, Ning Ding, is on the board of PSM ZJK:

ZJK reports that it puts a considerable amount of investment in its subsidiaries every year. It’s possible some of that investment comes back in related party sales as “round tripping”. This is shown below:

Source: ZJK IPO Prospectus

What’s also strange, is that ZJK’s investment in subsidiaries are the same number as its shareholders equity. This could mean that the accounting and auditing of the company wasn’t done correctly.

Source: SEC Filings

Conclusion

ZJK is a Chinese company that has been around about 14 years, making small gains. Instead of living off those gains, insiders decided they wanted to get rich. The path to riches, is going on a US exchange. However, they know that the western world wouldn’t want to invest in a boring nuts and bolts company. Therefore, they had to attach themselves to a big name, Nvidia, and a hot sector, AI, in order for investors to believe they are part of something big and exciting with lots of growth.

However, this sham is easily pulled back when one just looks at the company’s products. The company sells nuts and bolts. There’s nothing “cutting edge” about a product so simple. It’s a commodity and there’s no big markup or rapid growth in this industry. ZJK gives no explanation on how their parts are somehow unique to be called an “AI component”.

If investors want to invest in ZJK for their nuts and bolts, they are welcome to. However, this issue is also muddied as their sales growth is primarily from related parties. It’s impossible for investors to know how much of the related party sales are real, especially with the company’s continued investment in their subsidiaries, and the pre-IPO investors who got shares incredibly cheap at 7c per share. It is all connected.