Soliton – The Great Reg A+ IPO P&D PR Machine – $6 Two-Week Price Target

Soliton is a Reg A+ IPO, which means they could not get institutional investors, so they had to raise money from crowdfunding.

SOLY has put out 17 PRs since March, fueling a rally with no substance in our opinion.

SOLY’s first lock-up expiry is May 20th, and we believe it will be a bloodbath for the stock, similar to what happened to Reg A+ stock Adomani.

SOLY’s tattoo and cellulite removal devices are still in the pilot stage, unproven with few studies done.

SOLY’s biggest holder, Remeditex, has sold every significant position it has filed on sec.gov, and we doubt SOLY will be an exception.

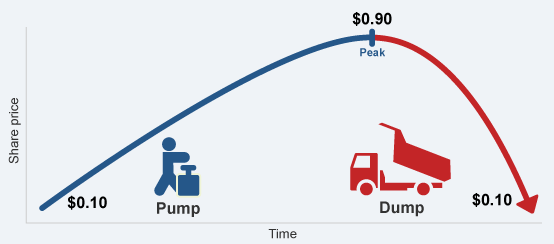

Soliton (SOLY) had a recent Reg A+ IPO in February 2019, with an unproven device that is supposed to assist a laser with tattoo and cellulite removal. SOLY is a relentless PR machine that we believe will end very badly for shareholders who think they are holding a solid investment. The company has put out 17 PRs since the beginning of March. This PR campaign has worked, as the stock has risen from $4.99 on March 1st to a peak of $15, to over $10 today. We don’t believe the PRs show any new important developments of the company. They just get people to buy shares.

Soliton posts on Twitter, Stocktwits and solicits Facebook fans in its PRs. The company is years from having an FDA approved product. Right now, they don’t even have a finished product to submit to the FDA. The company claims in their PRs to have over 200K “fans”. So what are these people fans of? Oh yeah, the stock! In our opinion, the company’s real product is its stock.

We believe long term holders planning to hold through the company’s May 20th lock-up expiry will have an unpleasant surprise coming. We predict the stock will fall to $5-$6 within two weeks.

Read the full report on Seeking Alpha here.