- Intrusion (INTZ) bought a fake award from something called Global InfoSec as a marketing tactic.

- In the Q121 earnings call, INTZ said that their customers haven’t paid for their Shield cybersecurity seats yet. This contradicts what management had told an analyst in a private email, and they earlier said that 90% of the companies from the beta testing became paying customers.

- None of INTZ’s Q121 revenues were from the Shield product, despite INTZ promoting it since the middle of 2020.

- B. Riley, INTZ’s sole IPO underwriter, key promoter and a supposed happy customer of the Shield, reduced its price target on INTZ to $13.50 from $30 after poor Q121 earnings results and a lack of guidance.

- The amount of lies and deceit from INTZ’s CEO, Jack Blount, is amazing.

- All of these lies will catch up to INTZ in their upcoming shareholder lawsuits, but the SEC might get them first.

- Intrusion (INTZ) bought a fake award from something called Global InfoSec as a marketing tactic.

- In the Q121 earnings call, INTZ said that their customers haven’t paid for their Shield cybersecurity seats yet. This contradicts what management had told an analyst in a private email, and they earlier said that 90% of the companies from the beta testing became paying customers.

- None of INTZ’s Q121 revenues were from the Shield product, despite INTZ promoting it since the middle of 2020.

- B. Riley, INTZ’s sole IPO underwriter, key promoter and a supposed happy customer of the Shield, reduced its price target on INTZ to $13.50 from $30 after poor Q121 earnings results and a lack of guidance.

- The amount of lies and deceit from INTZ’s CEO, Jack Blount, is amazing.

- All of these lies will catch up to INTZ in their upcoming shareholder lawsuits, but the SEC might get them first.

White Diamond Research has been writing bearish reports for over 7 years, and are one of the top small cap stock research firms. Intrusion’s (INTZ) management has shown itself to be possibly the most blatantly dishonest management of a public company that we have ever seen.

We published our initial bearish report on INTZ on 4/14/21. We brought up a lot of concerns about the company that investors weren’t familiar with. INTZ responded to our report but hardly addressed any of the issues we brought up.

INTZ has just shot itself in the foot again with buying a fake award. This is another shady tactic from INTZ exposing its “fake till you make it” mentality. While we are doubtful about the “make it” part, INTZ is adept at the faking part.

After their Q121 earnings results and earnings call, we have found things to be even worse than our expectations. Despite the company’s promotional efforts since mid-2020, its cybersecurity product, Shield, shockingly resulted in zero revenue for Q121 and there is no indication that it has started to generate revenue so far. Management also lied many times into the earnings report saying that they have paying customers of Shield. Due to this, we have lowered our 12-month price target to $2.50 from $4.

Intrusion Bought A Bogus Award That Has Tricked Investors

At noon on 5/17/21, INTZ released a PR titled:

INTRUSION Is Announced Winner of the Coveted 9th Annual Global InfoSec Awards During RSA Conference 2021

This “award” likely is the reason that INTZ went from a close of $10.84 on 5/14/21 to $15.08 on 5/20/21, for a 40% gain in less than a week.

Many people were excited about this award. For example, Jonah Lupton, an INTZ investor and Twitter stock commentator who has 535K followers, tweeted on 5/17/21:

Source: Twitter

Our research found that this is BS, the judges don’t vote on the winner based on a review of the nominees.

Source: Twitter

However, this PR is misleading. It’s a “pay to play” award. INTZ didn’t earn it, they paid for it.

The PR states:

INTRUSION, Inc. (Nasdaq:INTZ) is proud to announce the company has won the following award from Cyber Defense Magazine (CDM), the industry’s leading electronic information security magazine: “Most Innovative Intrusion Detection System”.

“We couldn’t be more pleased to receive one of the most prestigious and coveted cybersecurity awards in the world from Cyber Defense Magazine,” said Jack Blount, President and CEO of INTRUSION, Inc. “We knew the competition would be tough, and with top judges who are leading infosec experts from around the globe, we’re thrilled.”

Our research reveals that there is nothing to be proud of winning this award. Any company could win an award from this group, they just have to pay for it. “Competition would be tough” Blount is quoted above. There was most likely no competition at all.

Blount also says above this award is “one of the most prestigious and coveted cybersecurity awards in the world”. We are wondering how does Blount come to this conclusion? “Prestigious and coveted” by who? How is this statement measured?

Our research shows that this award is the opposite, because INTZ acquired it not through any merit, but from spending their money. Therefore, it shows that INTZ is desperate to go this route and deceive people.

A Look At Global Infosec, The Company That Gave Intrusion Its “Award”

On cyberdefenseawards.com, it says at the bottom of the page that the Cyber Defense Global InfoSec Awards for 2021 are provided by the Cyber Defense Media Group. That tells us it’s a media company that puts it on.

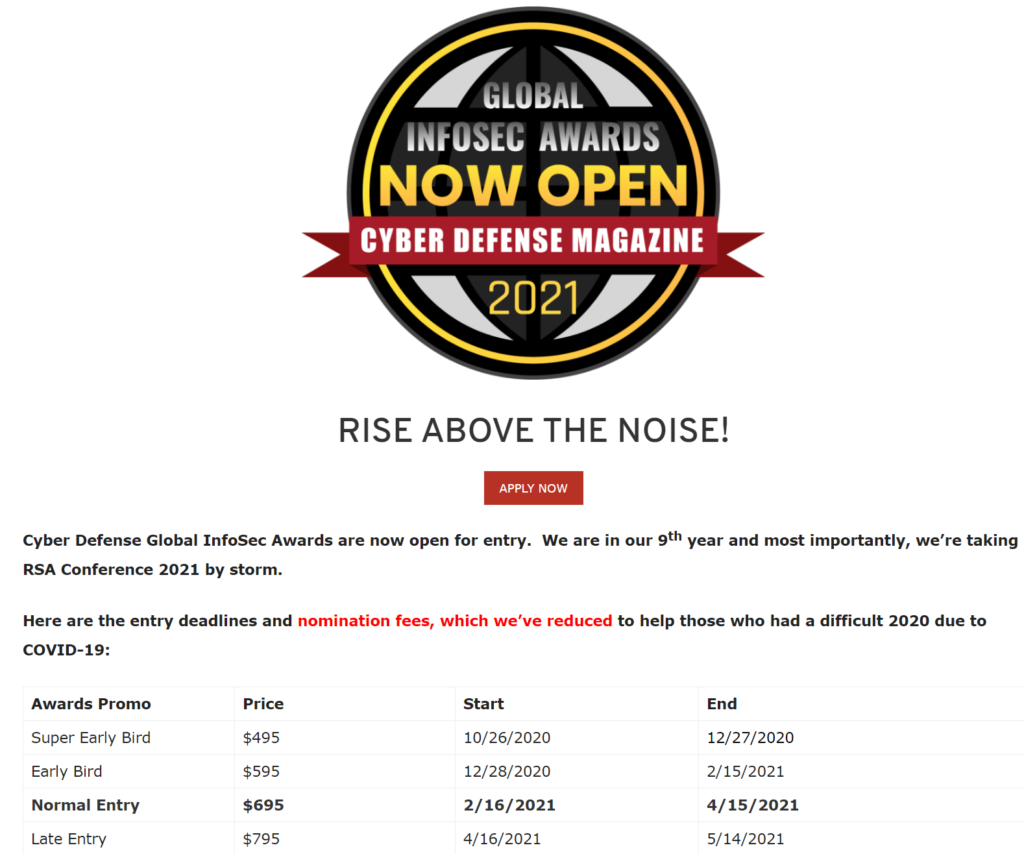

On the Nomination Information page, it shows:

Source: cyberdefenseawards.com

So to be considered for an award, the company has to pay for it (see “nomination fees” above). They list a ton of different categories of awards, so the company can choose which category they want to be in, and likely everyone wins as they will likely be the only company in that category. In fact, you can even create your own category as shown below:

Source: Cyber Defense Awards Category Page

INTZ “won” the “Most Innovative Intrusion Detection System” award. This is shown on the Global Infosec Awards for 2021 winners webpage. There are so many awards listed on that webpage, possibly hundreds, too many to count.

INTZ’s award didn’t exist in the Global Infosec 2020 awards, 2019 awards, 2018 awards, or the 2017 awards. It’s a new award category, therefore we suspect that INTZ created it.

Furthermore, Global Infosec provides marketing packages that one can buy to help a company market themselves after they’ve won the award. They are even still available for sale, as shown below:

Source: cyberdefenseawards.com

Blount Lies To People In Private Saying That Shield Seats Are Paid For, And Then Said They Really Aren’t In The Earnings Call

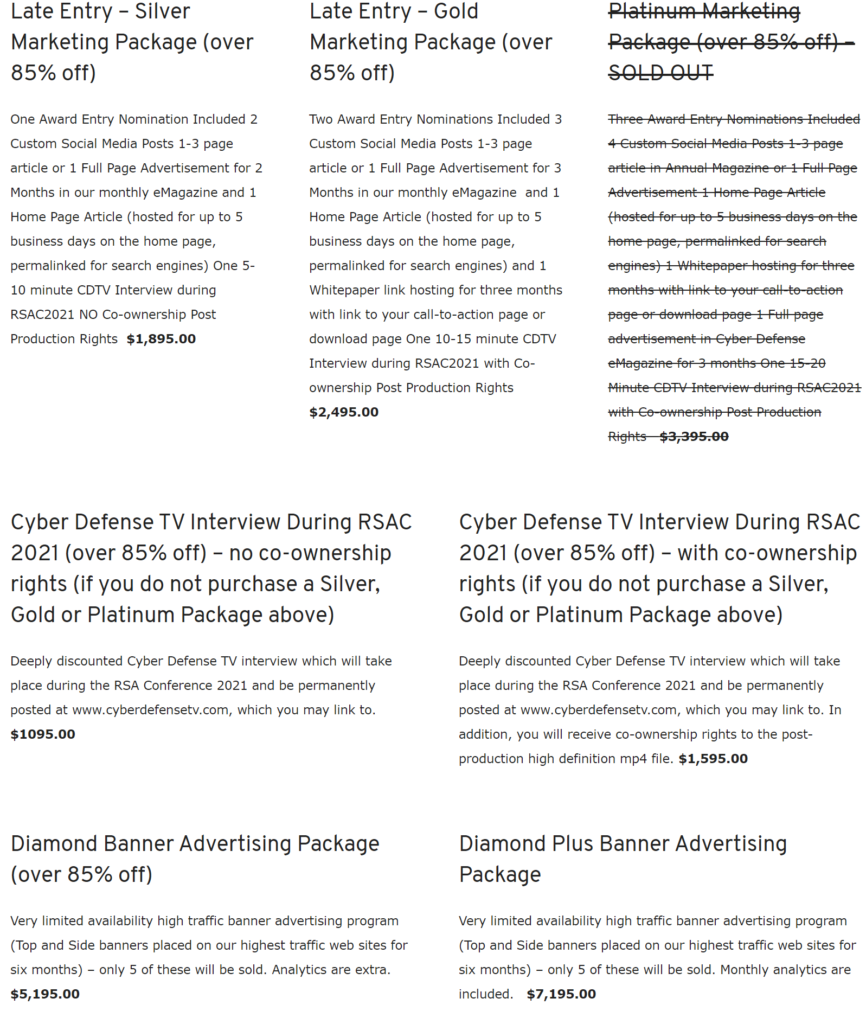

YouTube stock commentator Ash Anderson posted a video on INTZ on 4/19/21. This was after we published our report on 4/14/21. Ash was skeptical in the video but wasn’t extremely bearish like our report is. He ended up having a banter with Blount over email. Ash sent me a screen shot of an email that Blount sent to him on 4/20/21:

Many of the statements Blount makes in the above email are outright lies, confirmed from what the company itself said in the Q121 earnings call on 5/8/21.

For example, Blount says regarding the 50K Shield seats the company claims they sold: All 50,000 seats are paid.

However, Blount said in the Q121 earnings call:

Well, we don’t have the exact number of those that are paying today versus our signed under contract.

THIS IS ILLEGAL! A CEO of a public company can’t share bogus company information in private and then say the exact opposite in a public call. INTZ will have to answer for this in court when it’s defending itself against all of the shareholder lawsuits. That is, unless the SEC gets to them first.

Then, Blount says in the email above that Kimberly Clark signed a 3-year license that covers all of their servers.

However, he again contradicts this in the Q121 earnings call saying:

Certainly there is the intent and the desire that Kimberly-Clark will be rolled out fully within 12 months from the very first discussions I have with them. I have not seen a schedule and there is not technically anything in our contract that requires them to implement it in a certain time frame.

So what that means is Kimberly-Clark signed a license agreement that doesn’t obligate it to ever implement the Shield product under any deadline or pay INTZ any money. That’s not a real license agreement. That’s a “maybe we will use it if we feel like it” agreement, that could’ve been signed by anyone in the company.

Anderson, who is a software engineer, stated that all of the engineers at his job, about 30 of them, are on Linkedin. However, looking at INTZ’s LinkedIn profile, there are about 80 employees, but only about five engineers shown. Much less than the 40 that Blount says they have in the email.

Intrusion’s Q121 Earnings Results And Call Was A Worst Case Scenario

We were bearish on INTZ before the earnings call. After the earnings call, we are now even more bearish. It was worse than anyone following the company could imagine.

INTZ didn’t give any guidance or estimates about the revenue ramp for the Shield product. If the company doesn’t know when its customers will pay for Shield, then we believe it means that it isn’t something their customers need or care about.

Intrusion’s Own Investment Banker Gave It A Huge Downgrade After Its Q121 Earnings Results

- Riley was INTZ’s bookrunner for its IPO/uplisting from the OTC to the Nasdaq. The stock was set at an IPO price of $8 per share.

- Riley was a customer in Shield’s beta test, and continued to promote the stock with a price target of $30.

As a reminder, B. Riley was even quoted in a INTZ PR as a happy customer of Shield, it stated:

“This product just does not exist in the market today and is sorely needed,” said Aaron, chief information security corporate officer (CISCO) for B. Riley Financial, who participated in beta testing.

Yet B. Riley must not have paid for Shield since Shield revenues in Q121 were zero.

On 5/5/21, after INTZ reported Q121 results and he asked questions on the earnings call, Zack Cummins downgraded INTZ from Buy to Neutral with a new price target of $13.50, way down from $30.

From theflyonthewall.com:

Cummins says that given the lack of transparency into key metrics and the limited visibility into the revenue ramp in the coming quarters, execution risk is elevated versus consensus expectations moving forward. He sees further downside risk in the shares if the Shield revenue ramp does not meet consensus expectations in the coming quarters.

We respect Cummins for being able to switch his outlook from bullish to bearish, even though B. Riley is INTZ’s investment banker and took part in the beta testing. That’s rare in a sell-side analyst. This also makes it more likely that B. Riley didn’t become a paying Shield customer. We expect Cummins price target will get closer to our $2.50 price target as INTZ continues to fail to receive revenues for Shield.

More Jack Blount Lies

Blount has lied publicly about his achievements, deceiving shareholders about Blount’s fitness for his current role.

Blount lies on a podcast interview on 2/16/21, stating:

(Starting at time stamp 6:57)

I sold my last business 9 years ago, and thought I’d be retiring on a ranch in Texas, and I got called by the President of the United States and he said that they have had a severe breach of the government, and that they needed my help and would I come be a consultant for the government. So I flew up to Washington DC to see if I could help them. I did resolve their problem for them very quickly. And as a result, he made me the CIO of cybersecurity, kind of the czar for the Federal government for 4 years.

Blount’s cover letter from jackblount.com tells a different story. It states that he was hired by the Secretary of USDA, not the President of the United States. Blount worked for the United States Department of Agriculture in New Orleans, LA, he wasn’t the CIO/Czar of the federal government.

Queens Borough Public Library‘s Lawsuit Against Blount’s Company

In 2009, Queens Borough Public Library sued SirsiDynix alleging a “fraudulent bait and switch scheme” during its procurement of the Horizon library automation system in 2005.

In 2005, when Sirsi and Dynix merged, Jack Blount was the CEO of Dynix. He stated:

“Dynix customers on a path toward Horizon 8.x/Corinthian can be confident that SirsiDynix will complete this next-generation ILS,” said Blount. “We’ve invested tremendous time, energy, and resources in researching and developing 8.x/Corinthian – that’s why we’re confident that this new platform offers numerous compelling features and benefits to current and prospective customers.”

Beta testing of Horizon 8.x/Corinthian will begin in fall 2005, with general release scheduled for first quarter 2006. Horizon 8.x is the ILS solution for public, special, and school libraries; Corinthian is for academic and research libraries.

This sounds similar to how Blount talks about Shield. Such as from the Q420 earnings call (which was held on 2/25/21, in the middle of Q121), when asked by the B. Riley analyst (Cummins) about paying customers of the Shield product, Blount claimed that 90% of the beta customers became paying subscribers of the Shield product, which we know after the Q121 earnings call was a lie.

Zachary Cummins

- Riley Securities, Inc., Research Division

I appreciate the commentary around the opportunities for Shield ahead. Jack, I know after your beta tests have completed at the start of this year, it sounds like a majority of those customers have went on and became actually paying customers for Shield. Is there any way you can kind of quantify the opportunity there, just within the beta participants, just to give us a sense of the potential seed opportunity?

Jack B. Blount

President, CEO & Director

I can tell you, as we said before, 90% of our beta customers became paying subscribers on the Shield product. I would have liked to have had 100%. I’ve never before, in my history, seen a company accomplish 100% of beta customers. In fact, I can’t really find a company that had 90% of their beta customers convert. So I think that’s a very, very impressive number, that we were able to do that. I can tell you that one of our former beta customers, which is now a purchasing beta customer, is using the product at multiple locations here in the United States and is rolling — planning to roll out, as soon as we get approval, in 6 foreign countries. They are a worldwide business and they want to be protected worldwide. They want Shield running in every one of their offices around the world.

Also, based on Blount’s comments, it seems that he was referring to Kimberly-Clark (“a worldwide business”). Turned out, Kimberly-Clark is not a paying customer.

Franklin Byrd:

In terms of guidance, we will continue to [Technical Difficulty] our current policy of not providing quarterly guidance at this time, due to the fact that we are still in the early stages of ramping orders on Shield. As we stated previously, it’s very difficult at this stage to accurately predict the exact nature and timing of the revenue ramp but we’ll continue to reevaluate this on the quarters ahead.

This is a bad sign that they can’t provide guidance, even for Q221 which is halfway finished.

Conclusion

Our non-medical opinion is it’s clear from the evidence that INTZ’s CEO, Jack Blount, is a pathological liar. We hope, for his sake, that he can get the professional help he needs.

There’s the fake award that INTZ bought that Blount said was

“one of the most prestigious and coveted awards in the world”, when just the opposite is true.

There’s the zero revenues from Shield last quarter, even though Blount said mid-quarter that 90% of the companies in the beta test were paying customers (past tense). Blount said all 50K seats are paid for, when the reality is none of them are.

There’s the Kimberly-Clark “license” which is really nothing. Kimberly-Clark hasn’t appeared to use it at all yet, and hasn’t paid INTZ anything for it.

These are a few of the many lies Blount has told. We mentioned more in this report, and there’s even more shown in our initial INTZ report.

Blount and INTZ will have to face the repercussions of the lies when they face the shareholder lawsuits in court. But we wouldn’t be surprised if this sparks an SEC investigation before that, and then things could get really ugly.