- Flora Growth (FLGC) is a startup Canadian cannabis producer with 95% of its operations in Colombia, including a cultivation facility.

- The company was incorporated on March 13, 2019. Essentially FLGC is a roll-up of low quality, cheap companies. The key asset that is supposed to grow cannabis, Cosechemos, was acquired in October 2019 for a mere $80,000.

- FLGC won’t be able to export cannabis to the US or most other major countries because politicians want their own countries to produce it. As well as interstate commerce laws prohibiting it.

- FLGC claims to be able to produce cannabis at $0.06/g but has not produced any yet to prove it.

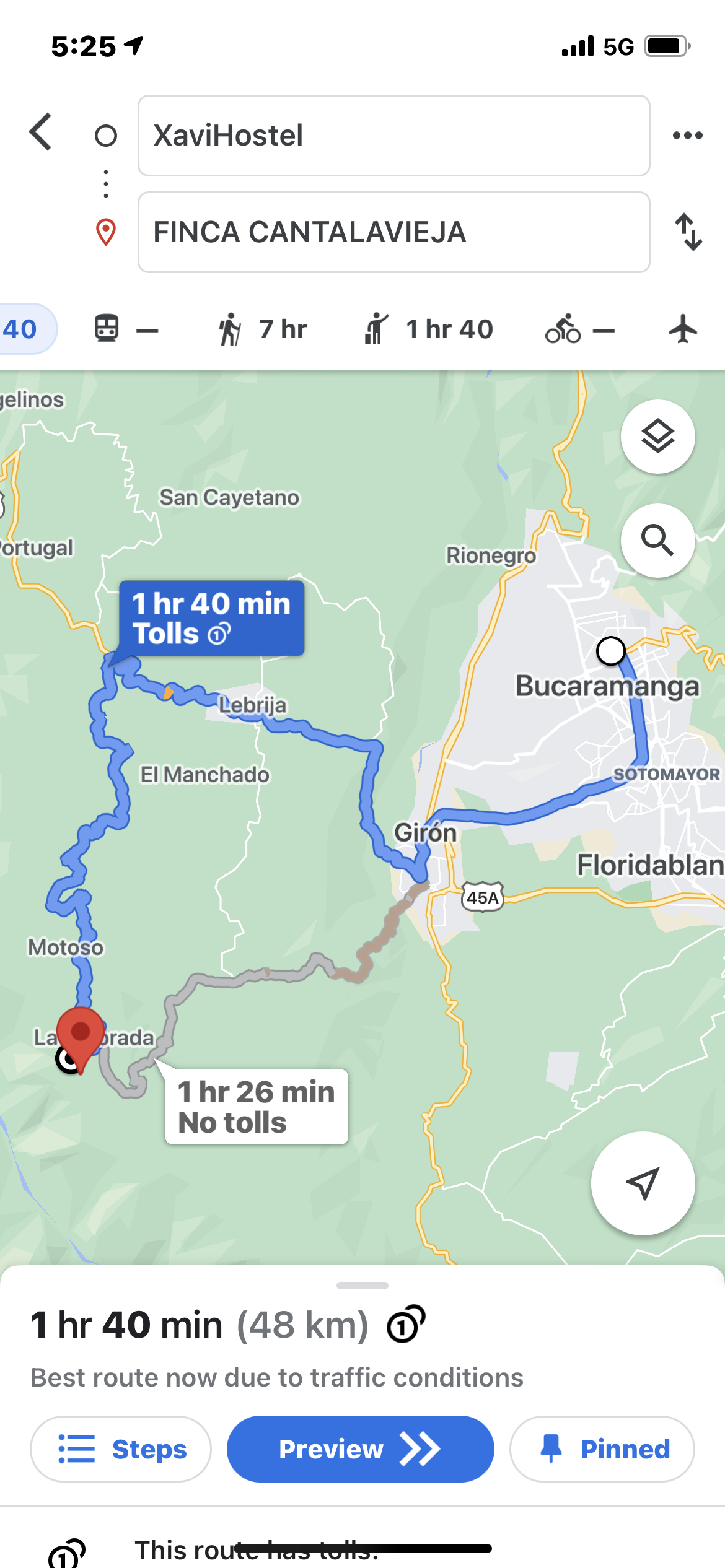

- We sent an investigator to see FLGC’s cannabis cultivation facility in Bucaramanga, Colombia and found that it’s in the middle of nowhere on rocky terrain, up a steep, muddy mountain. It looks impossible for commercial production and only an all-terrain vehicle could make the trip to ship the cannabis.

- No taxi or an uber driver in the area wanted to take the investigator up the mountain, he could only find a driver on a motor bike to do it.

- Our investigator wasn’t allowed to do a tour of FLGC’s cultivation facility, which raises questions about whether the business is real.

- Our investigator took pictures and video recorded everything, including the rough trip up the mountain, and an argument with an FLGC executive when he wouldn’t let him see the facility.

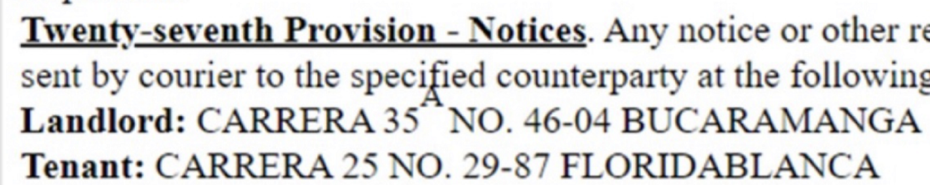

- Our investigator went to the office addresses that FLGC showed in their filings, but found they didn’t exist.

- FLGC’s co-founder and director, Stan Bharti, has recently resigned, right before a major unlock on 8/24/21, likely to sell his shares without needing to report it.

- Bharti is a Canadian financier who is heavily involved in junior mining. In his previous endeavors in junior mining Bharti got sued for extracting money from companies that he was involved in and ripping off other investors.

- FLGC has done several promotional campaigns before the lockup expiry on 8/24/21, which allowed insiders to dump over 8M shares.

- Luis Merchan, the CEO of FLGC, is only 39 years old. He doesn’t have any CEO experience, and before this job he worked at Macys and Target since 2007 in a wide variety of positions. He lacks the expertise to compete in the small but competitive cannabis export industry.

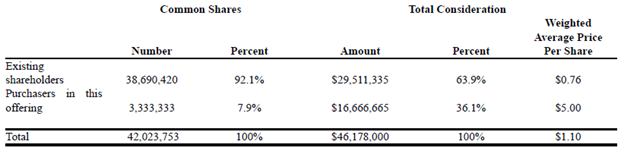

- Insiders bought shares in FLGC at average $0.76 per share price.

- Flora Growth (FLGC) is a startup Canadian cannabis producer with 95% of its operations in Colombia, including a cultivation facility.

- The company was incorporated on March 13, 2019. Essentially FLGC is a roll-up of low quality, cheap companies. The key asset that is supposed to grow cannabis, Cosechemos, was acquired in October 2019 for a mere $80,000.

- FLGC won’t be able to export cannabis to the US or most other major countries because politicians want their own countries to produce it. As well as interstate commerce laws prohibiting it.

- FLGC claims to be able to produce cannabis at $0.06/g but has not produced any yet to prove it.

- We sent an investigator to see FLGC’s cannabis cultivation facility in Bucaramanga, Colombia and found that it’s in the middle of nowhere on rocky terrain, up a steep, muddy mountain. It looks impossible for commercial production and only an all-terrain vehicle could make the trip to ship the cannabis.

- No taxi or an uber driver in the area wanted to take the investigator up the mountain, he could only find a driver on a motor bike to do it.

- Our investigator wasn’t allowed to do a tour of FLGC’s cultivation facility, which raises questions about whether the business is real.

- Our investigator took pictures and video recorded everything, including the rough trip up the mountain, and an argument with an FLGC executive when he wouldn’t let him see the facility.

- Our investigator went to the office addresses that FLGC showed in their filings, but found they didn’t exist.

- FLGC’s co-founder and director, Stan Bharti, has recently resigned, right before a major unlock on 8/24/21, likely to sell his shares without needing to report it.

- Bharti is a Canadian financier who is heavily involved in junior mining. In his previous endeavors in junior mining Bharti got sued for extracting money from companies that he was involved in and ripping off other investors.

- FLGC has done several promotional campaigns before the lockup expiry on 8/24/21, which allowed insiders to dump over 8M shares.

- Luis Merchan, the CEO of FLGC, is only 39 years old. He doesn’t have any CEO experience, and before this job he worked at Macys and Target since 2007 in a wide variety of positions. He lacks the expertise to compete in the small but competitive cannabis export industry.

- Insiders bought shares in FLGC at average $0.76 per share price.

Above: A Flora Growth executive attempting to grab the video recording device from the investigator.

Summary

Flora Growth (FLGC) claims that it cultivates, processes and supplies wholesale cannabis. It’s a Canadian company headquartered in Toronto, Canada, but has a cultivation facility in Bucaramanga, Colombia.

The company was incorporated on March 13, 2019. For the whole 2019 the company had no business to talk about: revenue was zero, net loss was $2.8m. In 2020 FLGC managed to generate a cool $100K in revenue and a not so cool net loss of $14.3m.

From the IPO prospectus dated 5/12/21:

“We have not yet grown nor harvested a commercial cannabis crop nor produced oil extracts, and we will require adequate proceeds generated from this offering to do so.”

“Further, until our Research Technology and Processing Center has been constructed and becomes operational, we will not sufficient infrastructure as a grower nor have the ability to extract CBD oil in any material amounts.”

“We are currently in discussions with distributors with whom we intend to contract although no definitive agreements have been signed.”

The company has been buying small businesses and real estate in Colombia (it spent about $2.5m on these deals).

FLGC’s crown jewel asset, Cosechemos YA SAS, was acquired in October 2019 for $80,000.

Cosechemos is supposed to grow cannabis. Operations haven’t started yet. From the prospectus:

- Medicinal-Grade Cannabis. Our revenues are expected to begin July 2021, through our 90%-owned subsidiary, Cosechemos YA SAS;

- Cannabis Oils and Extracts. Our revenues are expected to begin July 2021, through our 90%-owned subsidiary, Cosechemos YA SAS;

FLGC corporate structure:

Essentially FLGC is a roll-up of low quality, cheap companies.

FLGC acquisitions:

Note above that the key asset that is supposed to grow cannabis, Cosechemos, was acquired in October 2019 for mere $80,000.

Insiders bought shares in FLGC at average $0.76 per share price.

Flora Growth Insider Trading

On 8/12/2021, FLGC announced that its director and co-founder, Stan Bharti, resigned. He will transition to the role of a “strategic advisor”.

Bharti is likely the mastermind behind the company as he’s been financing FGLC since the company’s inception and is one of the largest shareholders.

Bharti served as Executive Chairman of the company since March 14, 2019 (remember that the company itself was incorporated on March 13, 2019), receiving base fees of CAD$12,500 per month. He resigned from his Executive Chairman position on December 16, 2020, but remained as a director of the company.

For 2020 Stan Bharti also received a $1.1m in cash fees from FLGC as director (the only director that received a cash award).

Bharti has also been financing FLGC via loans:

- QuestCap Inc. (formerly Copper One Inc.) – $500,000 loan. QuestCap is one of Bharti’s companies. Deborah Battiston, current CFO of FLGC, was also CFO of QuestCap.

- Sulliden Mining Capital Inc. – $500,000 loan. Sulliden Mining Capital is one of Bharti’s companies. Deborah Battiston, current CFO of FLGC, was also CFO of Sulliden Mining Capital.

- Q Gold Resources Ltd. – $16,667 loan. Q Gold Resources is another Bharti’s company. Deborah Battiston, current CFO of FLGC, was also CFO of Q Gold Resources. Fred Leigh, former director of FLGC, was also director of Q Gold Resources.

- FLGC itself provided a $1m loan to Newdene Gold Inc., another company in Bharti’s network.

Bharti is a Canadian financier who is heavily involved in junior mining. His investment company is called Forbes & Manhattan.

He likes to associate himself with established personas such as Larry King, who he called his advisor:

But his modus of operandi is probably better explained by another association – Jordan Belfort (of Wolf of Wall Street fame):

In his previous endeavors in junior mining Bharti got sued for extracting money from companies that he was involved in and alledgedly ripping off other investors.

This article documents a boardroom battle against one of Bharti’s companies that allegedly ripped off investors:

“Mr. Morris said he is concerned about lavish compensation practices at Aberdeen. According to regulatory filings, Aberdeen has paid a total of more than $10-million during the past three years in salary, bonuses and other incentives to its executive chairman Mr. Bharti, its executive vice chairman George Faught, and chief executive officer David Stein. During that time, Aberdeen reported more than $84-million in losses and its stock price tumbled from nearly $1 a share to below 20 cents on the TSX Venture Exchange.

Mr. Morris said he intends to challenge the change-of-control payments as contrary to shareholder interests.”

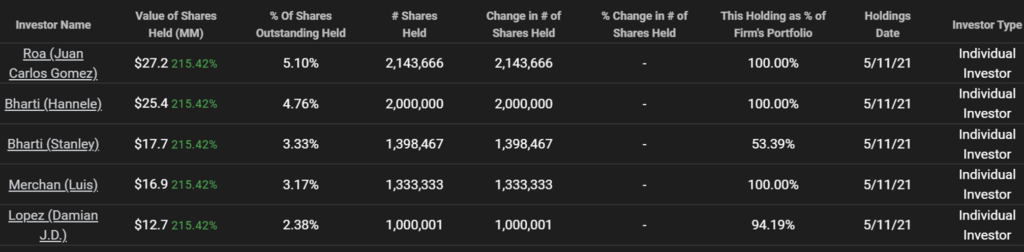

With this resignation, Bharti can now dump his shares without having to file the sale with the SEC. Bharti owned 1.4 million shares which is 3.3% of the outstanding shares of the company. Mr. Bharti’s wife, Hannele Bharti, also owns 2 million shares which is 4.76% of the outstanding shares. Their holdings are shown on tikr.com, screen shot below:

Source: Tikr.com FLGC ownership page

On 8/12/2021 Flora Growth announced with a press release that it “Applauds Nasdaq Board Diversity Initiative, appoints Lead Scientifc Advisor, Dr. Annabelle Manalo-Morgan, PhD to its Board of Directors.” This announcement is likely a distraction for the resignation of Director Stan Bharti, who can now freely dump his shares without any notice.

Flora Growth’s First Lock-Up Expiry Was For 8 Million Shares on August 24, 2021

When FLGC went public, it locked-up ~10.7M management shares (including for Stan Bharti and his wife) and another ~14.5M shares were locked up as “non-affiliated holders”. The lock-up was for 365 days but it had a small caveat which stated that:

“If after the first 90 days following the date on which the trading of the securities on the NASDAQ Stock Exchange commences, the closing bid price of the securities is $8.00 or greater for any ten consecutive trading days, and the average daily trading volume for the first 90 days is 100,000 shares or greater, then a shareholder subject to the lock-up agreement may sell up to 33% of his, her or its holdings with a limit of three percent (3%) of the average trading volume on any one day”

90 days after the IPO was August 9th and by our calculation, the escrowed shareholders became eligible to sell 33% of their shares on August 24th. That’s a total of 25.2M x 33% = 8.4M shares that insiders can now sell.

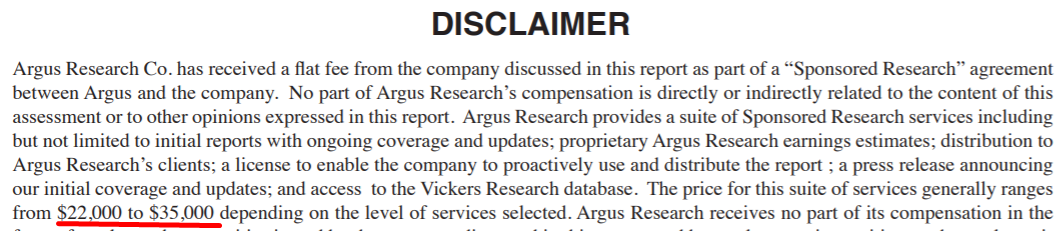

The company promoted the stock in order to meet the above qualifications so insiders can sell early. They hired Argus Research to publish a report on them. They made a string of non-synergistic acquisitions so they could drastically raise their revenue projections. They published a whopping 15 press releases (“PRs”) so far in July and August. Benzinga and Motley Fool published 10 articles on FLGC in July and August. FLGC also paid for several stock promotions, as shown below:

Flora Growth Has Engaged In Several Stock Promotions Ahead of The August 24 Lockup Expiry

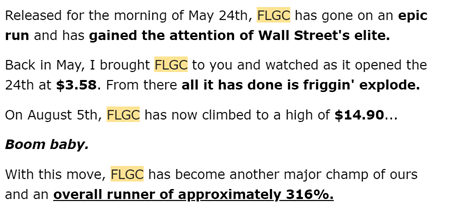

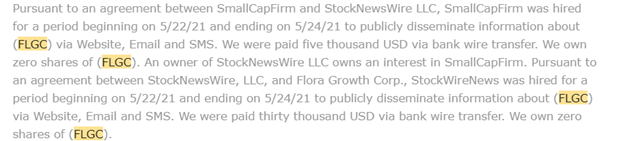

Back in May, FLGC was being blatantly pumped by StockNewsWire LLC which also owns SmallCapFirm.com. They were paid $30k for the pump. Below are screenshots from an email account that is registered on the promoter websites to receive the pumps. Along with these emails, were countless text messages in between for those that signed up on their site.

From the StockNewsWire email promotion:

And the disclaimer showing what they received from FLGC for the email promotion: $30K.

Another promoter, InvestorBrandNetwork (IBN) received about $40k along with $54k for advertising for more pumping on social media and more pumping. You can visit their paid disclaimer here, screenshot below:

FLGC’s warrants are already getting exercised. As stated in an FLGC PR on 8/19/21:

- At June 30, 2021, Flora’s cash balance was approximately $19M with minimal debt (unaudited).

- Subsequent to June 30th, we have been seeing a substantial cash inflow from the exercise of the warrants sold as part of the Regulation A. To date, we have received commitments of more than $10M (some unfunded), with $7.2M in cash received and an additional $1M pending clearing. We expect to see this amount continue to grow over the following weeks.

FLGC’s warrants are listed in its IPO prospectus, some with only a $0.05 exercise price.

Flora Growth Cannot Export To the US Market

FLGC has recently benefitted from sentiment around Colombia’s recent announcement on Friday, July 23, 2021, that they would allow the export of cannabis flower.

All the Colombia cannabis grower names rallied on the news, such as PCLO, Khiron, etc. got pumped) and so did Flora.

But the news isn’t as good as investors might think. First, as stated in this article about Colombian’s legalization:

“However, the global export market remains small and competitive, so even if flower exports are allowed, it won’t be a panacea for the Colombian cannabis industry struggles.”

Therefore FLGC, a new Colombia cannabis producer, will struggle along with its competitors in Colombia.

Second, another problem for FLGC is that they aren’t going to be able to export it to a major country like the US. Not because Colombia won’t allow it, but the US won’t allow it. They aren’t going to allow imports from Colombian grown cannabis. The US politicians would rather they grow cannabis in their own district than import it. That way, they get the full return on the taxes and their communities will get the full profits from the sale.

Foreign cannabis companies cannot export cannabis to the US because cannabis is federally illegal and interstate commerce is prohibited. Canadian cannabis companies (such as Canopy Growth, Tilray (that recently merged with Aphria), Village Farms, and many others) have been salivating about entering US cannabis market for many years. All these Canadian companies have plenty of excessive capacity to grow cannabis that the Canadian market cannot fully absorb. But again, they cannot sell to the US as cannabis is federally illegal and interstate commerce is prohibited in the US. At the same time, US-based multi-state operators (such as Curaleaf, Columbia Care, Trulieve, and many others) are fighting for market share and building moats around their businesses. In short, even if cannabis becomes federally legal in the US, there is simply no place for such miniscule players as FLGC, which have to compete with Canadian companies that have plenty of capacity to serve the US market and with US-based companies that are already building moats around their business in the US.

A Paid Research Report Confirms that Flora Growth Will Have Exportation Troubles

On 7/21/21, Argus Research published a research report on FLGC. As shown in the disclaimer at the bottom of the report, this was paid for by FLGC. It states:

Source: Argus report on FLGC

The report states:

“Wholesale cannabis imports are currently legal in about 15 countries, including Germany, Italy, Portugal, Israel, South Africa, and Australia. While it will likely take time to penetrate these markets, we expect Flora to emerge as an important cultivator and global supplier of quality cannabis given its significant cost advantages.”

So a bullish, biased report for FLGC admits that it cannot export to the US, as its not listed in the above countries that allow cannabis imports. The passage above even says “will likely take time to penetrate these markets” so it’s questionable whether FLGC will ever be able to export to even those countries listed.

We believe FLGC will have trouble exporting to any major country, for the same reasons they can’t currently export to the US. The politicians would rather have their own people grow it so their local districts will receive all the profits and taxes.

Another example is Germany (which is being touted by cannabis companies as one of key markets in Europe). Germany remains a small market as stated in this article from 11/18/20:

“The cannabis flower category is declining both in terms of the number of prescriptions and the total euros reimbursed by statutory health insurers.”

The article also states:

“Exporting to Germany remains one of the most attractive international revenue opportunities for cannabis producers with a global vision.

But today’s German flower market isn’t as supply-constrained as it has been in previous years.

Moreover, with prices declining, exporters should no longer expect to receive premiums that previously had been achieved in the German market.”

The above statement suggests that FLGC is late to the game, and won’t be able to receive premiums that Germany used to offer cannabis exporters.

Our Investigator Visited Flora Growth’s Cultivation Facility in Bucaramanga, Colombia And Found Its Likely Not Commercially Viable

Luis Merchan, the CEO of FLGC, is only 39 years old. He doesn’t have any CEO experience, and before this job he worked at Macys and Target since 2007 in a wide variety of positions, as shown on his LinkedIn page. He lacks the expertise to compete in the small but competitive cannabis export industry. In an interview with Seeking Alpha on 5/24/21, Merchan stated that 95% of FLGC’s operations are in Colombia. Colombia is a poor, 3rd world country in South America.

David Capablanca of The Friendly Bear Podcast/Research took a trip as our lead investigator to check out FLGC’s Colombian operations. This consists of FLGC’s cultivation facility and office in Bucaramanga, Colombia. What he found was shocking.

We gave the company the benefit of the doubt, but David visited and found that FLGC’s office listed in the SEC filings doesn’t exist.

FLGC’s cultivation facility is far from a legitimate commercial operation. There were hardly any employees working there. The road to get there is terrible. It’s 2 hours of bumpy road, dangerous terrain, mudslides, rocks, and volatile weather that can cause a mudslide at any moment. As you get closer to the site, the hills get steeper, almost vertical. An all-terrain vehicle is the only way to access it. There’s no way to ship any product in trucks over that terrain in commercial quantities. David accessed it by riding on the back of a driver in a dirt bike. For the steep hills, David had to get off the bike and hike up the hill as it was too hard for a motor bike.

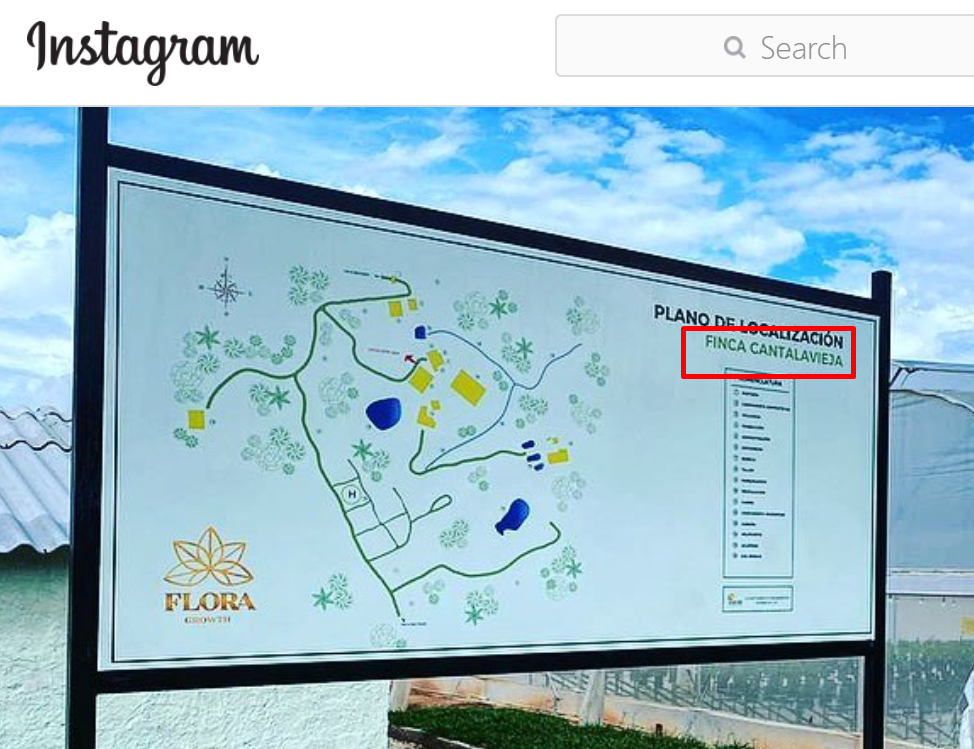

First, we found that the cultivation site is located in Motoso, Colombia. Motoso is a suburb of Bucaramanga; it’s a mountain-side town. The farm is called Finca Cantalavieja.

We saw a sign from pictures online, on this Flora Growth Instagram page, that shows the Flora Growth logo and a caption “FINCA CANTALAVIEJA”, as shown above. This discovery allowed David to search for the site on Google Earth and match up the aerial photos of the site on social media together. The photos didn’t show much regarding the cultivation facility. But what David found was much worse than what was shown on the Instagram page. The trip up the mountain was very difficult and hazardous.

“If I wasn’t in good shape, I wouldn’t have made this trip. A couple years ago, when I had back problems, I wouldn’t have been able to make it,” said David.

He went there to arrange a tour of the cultivation facility. An FLGC executive first said he could have a tour, but then he changed his mind.

The Chronological Story Of The Trip To Flora Growth’s Cultivation Facility

First, to set up the trip, David exchanged emails with the investor relations rep of FLGC which is Evan Vernyard. Evan was supposed to call back to schedule a tour for David. However, Evan never called at their scheduled time to setup a tour of the facility. David went ahead and took a trip to Bucaramanga anyway to see if he can get some footage of FLGC’s cannabis cultivation facility and offices. He recorded the trip with pictures and videos.

David arrived in Bucaramanga on 8/7/21 at 9pm. He was picked up from the airport in a motorcycle by Xavi, the owner of the hostel where he booked a room. David traveled light with only a backpack, which was good for the motorcycle ride. Xavi also agreed to give David a ride to FLGC’s cultivation facility the next day for a small fee. The following is a picture of the motorcycle the next day, when they prepared for the trip.

The following is the map from the Hostel to the Flora Growth cultivation facility:

David didn’t realize how treacherous the journey was on the first day, so he didn’t take any footage of the trip to on the first day.

“I was just holding on for my life on the back of the motorbike, I wasn’t considering filming the trip on the first day”, said David.

It wasn’t easy to find the cultivation facility. They had to ask around halfway through the trip because there wasn’t a clear path there. They were sent in the wrong direction many times. It took over 3 hours for them to finally arrive. When David arrived on the Sunday afternoon of 8/8/21, he first saw the gate, video here. Below is a snapshot of the video with a sign on the gate that says “Bienvenidos” (welcome). There is a sign behind the gate that says “Flora Growth”:

Source: YouTube video FLGC site visit

Below is a closer picture of the Flora Growth sign taken by David:

When he arrived at the gate, Xavi honked the horn of the motorcycle. Then a security guard with a gun came and greeted them. David said he’s an engineer coming to check out the property, and that he’s a potential investor who wants to take a tour. The security guard then said “let me call the manager”, and called Javier Franco, the VP of Agriculture for FLGC.

Here’s Javier Franco’s profile pic from floragrowth.com:

Source: Flora Growth Team Web Page

Because there is no cell phone coverage or Wifi in the area, since it’s in such a remote location, the security guard let David and Xavi go inside in order to get Wifi to make the call to Javier. There was no internet signal at the gate. Once in, he was able to speak with Javier. Here is the video and transcript of David’s first trip to the FLGC cultivation facility.

A partial transcript from the video:

Security Guard: Do you want to talk to the engineer? (Asks David, then passes the phone to him, but there is no reception. The “engineer” the security guard is referring to is Javier Franco)

David Capablanca: Hola, Javier? (Phone has no signal, guard opens gate)

Security Guard: (Opens front gate) Let’s go inside to get wifi for reception.

(Security Guard & David C. walk over to the Flora Growth office area with wifi.)

Security Guard: Hello? (Speaking on phone with Javier) I’m here with the visitor.

Then the security guard passed the phone to David. David spoke with Javier Franco to coordinate a time that he can have a tour of the growth facility. Javier said that today was “impossible” but to try “tomorrow after lunch”. Remember, that this is a tough, 2-hour ride up a mountain with a really rough road. So it’s important that David gets in the tour the next time, because it’s unlikely there will be a third try.

More clips from the video:

Javier Franco: I apologize David, we can’t let anybody enter.

David Capablanca: It’s okay, can we schedule in two days then? Is that possible?

Javier Franco: Yeah, tomorrow. If you give me your ID, Tuesday is perfect.

David Capablanca: Tomorrow even? Or it doesn’t matter? The sooner the better.

Javier Franco: I don’t know if I can on Monday, maybe in the afternoon.

David Capablanca: Tomorrow after lunch?

Javier Franco: Yeah, we have to notify the authorities in Bogota. Give me your name, ID number, telephone number so I can reach them tomorrow morning.

David Capablanca: It’s ok, what was your name? …so I can remember it for tomorrow.

Javier Franco: Javier, Javier.

David Capablanca: Javier?

Javier Franco: Javier.

David Capablanca: Sounds good. I will give him my information and hopefully tomorrow I can come here after lunch.

Javier Franco: Thanks.

David Capablanca: No problem, Javier.

Javier Franco: Thank you, David.

As shown in the dialogue above, Javier suggested that David return the next day after lunch. David and Xavi then left, and it took them 2 hours to get back to the hostel. This 14 second video shows the beginning of the long ride back to the hostel. To view more short clips of the ride back, check the Flora Growth (FLGC) playlist on the Friendly Bear Research YouTube page. It shows more videos of the entire trip.

This shot shows the only market on the way down from the mountain:

David returned to the hostel and went to bed.

The next day, 8/9/21, Xavi had to go out of town. David took that day to look at the offices that were listed in FLGC’s SEC filings.

It turns out that FLGC doesn’t have any offices in or around Bucaramanga, despite making that claim in SEC filings. As shown in this filing:

Source: FLGC For 1-A/A filing

FLGC’s office location shown above in the SEC filing is Carrera 25 #29-87, Floridablanca. The address in Bucaramanga is FLGC’s landlord’s address. David visited the address in Floridablanca, which is a neighboring city to Bucaramanga. From the same SEC filing, it says that FLGC rents its office at the mall at address “Local 17A”. David looked for it and found that it doesn’t exist at the mall. The following are some pictures he took at the mall:

Floridablanca Mall Pic

Floridablanca Mall Pic

David later went to his room at the hostel and ended the day.

Xavi told David at the hostel that his bike got messed up from the trip up the mountain to Flora Growth with all the mud. He said he must get the bike fixed before taking David on another trip up the mountain. The bike had to spend the entire next day at the mechanic’s shop. The trip is so hazardous that it would likely mess up any vehicle. David tried to take the trip with an Uber or taxis, but none of them wanted to take the trip up there.

While David was in the courtyard looking for a taxi, he said the following monologue, describing his experiences so far trying to visit FLGC’s cannabis growth facility. He filmed the area while he was talking which can be seen with the transcript in this video. Part of the transcript is below:

“In order to visit the site, you have to know Spanish, you have to ask everyone along the way, which is not many, you have to go up the mountain roads, the mud, no lighting, very narrow dirt roads that you can’t do U-turns, you can’t take a car up there, so the only way to go is by motorbike, unless you want to hike and get really dirty because it’s all mud because it’s raining all the time, everyday showers come in for a portion of the day, it goes away, comes back, goes away comes back….There’s no clear Flora Growth in Google pointed on the map. I mean they are so proud of their site, they have photos of it all over Instagram, all over YouTube all over everything- why don’t they just plot it on the site?”

The next day, 8/11/21, David and Xavi left the hostel at 9am to return to the Flora Growth cultivation facility. They arrived at about 11:30am. They went to the gate and a different security guard approached them to see what they were there for. David said in Spanish that he’s an investor and that in his previous visit, Javier told him to come for a tour. The security guard didn’t let him in.

Shortly, Javier approached David at the gate. He said David couldn’t take a tour because he had to get the OK from Evan Vernyard, FLGC’s investor relations rep. The following is a snapshot of the video showing Javier at the gate, not letting David in and then trying to grab his phone while he’s recording:

The following is the main part of their conversation, from this video:

David Capablanca: You told me I could come for a tour, so why can’t I see the plants?

Javier Franco: I didn’t say you can come for a tour.

David Capablanca: That’s what you said. You said I can come Monday or Tuesday.

Javier Franco: I didn’t say a tour at all. I said if Evan confirms. Let me talk to Evan. If Evan confirms, I will let you in and I have to confirm and give you the ID to the authorities so that they…

David Capablanca: You guys made me come all the way over here for nothing?! It’s really messed up.

As shown in the transcribed dialogue above, Javier starts talking about getting permission from Evan, and then talks about getting David’s ID for the government authorities, and then he trails off. This is a different attitude than when he clearly stated in their first conversation that David should come back the “next day after lunch” for a tour of the property the next day.

This doesn’t make sense that Javier needs permission from Evan to give David a tour. Evan is a 27 year-old working in an investor relations role for FLGC. An investor relations role isn’t a position to be giving permissions to executives. Javier is an executive, the VP of agriculture, 52 years old and has lots of experience, has been in the plant cultivation business for 25 years, as stated in his profile on FLGC’s website. He should have been able to make the decision himself to give David a tour. In their first conversation, Javier had suggested that David come back the next day for a tour. David in fact returned two days later, and Javier was still not prepared to let him in. We believe this is evidence that the company doesn’t want to show the cultivation facility to the investing public, because they have something to hide.

Flora Growth’s Partnerships Have Issues and Generate Insignificant Revenue

On 7/17/21, FLGC announced a partnership with a Canadian company, Avaria Health & Beauty Corp, to market and distribute a cannabis cream in Latin America which spiked the stock. The PR makes it seem like this partnership is a big deal for FLGC, as it states:

“We are very excited to partner with Avaria to bring their established, award-winning KaLaya brand to our LATAM distribution network. We believe the product will receive a similarly strong reception as it has in Canada,” commented Flora Growth President and CEO, Luis Merchan.”

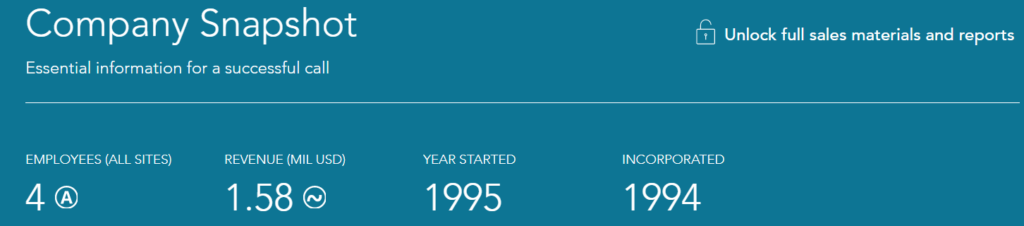

However, Avaria is, in reality, a tiny company. As shown on Dun & Bradstreet, Avaria only has 4 employees and generates only about $1.58M per year. This is shown on dnb.com on Avaria’s company snapshot:

Source: dnb.com

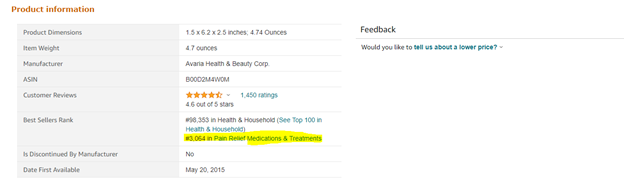

Avaria’s key flagship product brand mentioned within the distribution deal is KaLaya Naturals. KaLaya has a listing for their pain relief cream on Amazon.com that appears to be successful, until you check product information. The product is rated #3,064 within the Pain Relief Medications and Treatments category

The product will also be distributed in Latin America, at FLGC’s expense, and the two companies will split the profits. On top of having to distribute a completely new beauty brand, it seems unlikely FLGC will make any significant profits. The average income in Colombia is much lower than countries such as the United States and Canada, and it will be harder to break into the market with a luxury cannabis crime priced at ~$21/pack.

We Doubt Flora’s Ability To Execute On Its Business Plans

Other than cultivation, FLGC has several business units that it has either built out or acquired. Based on a review of these business units, we are highly skeptical of Flora’s operational abilities. In 2020, FLGC did about ~$106K in sales, $78K of which came from its beauty division, Mind Naturals, which includes products such as CBD Moisturizer and CBD Masks. By our estimates, the brand launched in ~August 2020 and in 4 months, we estimate sold just ~3,500 to 4,500 units. These numbers might be good for a small beauty startup, but are abysmal numbers for a ~$500M public company.

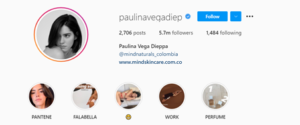

Their beauty division was created in collaboration with former Miss Universe Paulina Vega, a notable influencer with over 5.7M Instagram Followers. The company’s investor presentation states that “With 5 million+ Instagram followers, Ms. Vega may help drive sales through e-commerce channels”. On the social media aspect however, it seems the initial hype surrounding Vega joining the brand and endorsing it has gone down. Mind Naturals Colombia has ~16.5k followers yet averages less than 100 likes per post. Furthermore, Paulina Vega has removed Mind Naturals from her bio on Instagram. See below from a screenshot that we took on August 2nd compared to a screenshot that we took on August 23rd

August 2nd

August 23rd

In December 2020, FLGC acquired other companies including Kasa Wholefoods and a drug distributor known as Cronomed. The proposition Flora makes is taking these traditional channels and introducing CBD into them. However, these divisions have their own potential problems.

Kasa Wholefoods is a company that Flora acquired from another Colombian Celebrity called Laura Londono. One of the key products of Kasa was an organic juice known as Mambe. Like Mind Naturals, Mambe’s Instagram also shows very low level of engagements for a company run by a celebrity. Kasa Wholefoods/Mambe had sales of only $344K in 2019. Most of Mambe’s sales (~86%) came from 1 coffee chain known as Tostato. This article states that Tostao sought an application for a business recovery process (essentially bankruptcy) in July 2020.

As per FLGC’s own filings, Cronomed offers 56 products most of which are products such as anti-biotics, gastrointestinal drugs and even a product for erectile dysfunction. Flora states that Cronomed is focused on distributing products to wholesalers, pharmacies, and retailers (mostly pharmaceutical and OTC products). We think that it will be fairly hard to introduce CBD into this distribution framework.

Diluting shareholders further, on 6/14/21, FLGC recently acquired hemp brand Koch & Gsell Vessel Brand for $22.2M in FLGC shares at a deemed price of $5 per share. This will add 4.44M outstanding shares. On 8/17/21, FLGC acquired vape seller Vessel Brand in $30M in cash and stock. Yet even more small acquisitions for the roll-up.

Conclusion

We believe the strongest point to the bear case is that the company’s cultivation facility is located in the middle of nowhere and the trouble they will have of shipping the cannabis down the mountain on those hazardous roads. Coupled with the many other red flags we mention in this report. Including that their Colombian office doesn’t appear to exist, and there isn’t much going on yet in their cultivation facility, which they are hiding. Also, the cannabis export market is small and competitive, and will only get worse as countries would rather grow and make money with their own cannabis.

FLGC has made many acquisitions this year and late last year. This allowed the company to forecast high revenue growth. However, that growth is inorganic, as FLGC has turned itself into a roll-up, acquiring many businesses that don’t seem to have synergies. Just because two companies sell cannabis-related products, doesn’t mean they are synergistic. It was important for FLGC to put out newsflow and raise revenue guidance to get its stock over $8 for 10 consecutive trading days, so insiders can sell 33% of their positions, which equal about 8M shares. But logically, if FLGC is paying $20-$30M for these tiny businesses, which likely won’t add cost synergies, then why should the company valuation increase by hundreds of millions of dollars like it has? We generously assign a $2 price target on the stock, for a valuation of about $110M. If the company underperforms, which we think is likely, then a $1 price target, or roughly $55M valuation, would be more appropriate.